Deutsche analysts: Joe Liew, CFA and Joshua Lee, CFA

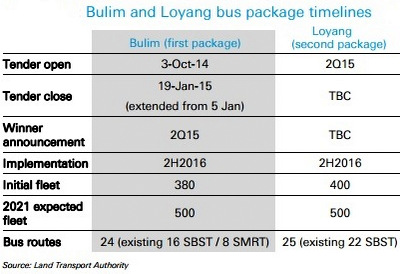

Loyang bus depot to primarily service the eastern edge of Singapore Transport Minister Mr Lui Tuck Yew indicated in Parliament that the second bus package under the Government Contracting Model (GCM) will consist of bus services operated out of Loyang bus depot and deployed out of Changi Airport Bus Terminal, Changi Village Bus Terminal, Pasir Ris Bus Interchange as well as Punggol Bus Interchange.

The package will consist of about 400 buses when implemented in the second half of 2016, and will increase to about 500 buses in 2021. The depot is scheduled to be completed in June this year and will be able to accommodate about 500 buses.

|

|

Maintain Buy on the land transport sector with multiple upside catalysts ahead  Deutsche has a buy call on ComfortDelgro at $3.76.

Deutsche has a buy call on ComfortDelgro at $3.76.

NextInsight file photoWe believe that despite a slight delay, subsequent policy announcements would add more clarity on

(1) winner bids and costs, which should justify our forecasted 9% EBIT bus margins under the GCM,

(2) timeline and quantum of bus asset sale, which we estimate would be a lump sum payout of S$850m for CD and S$300m for SMRT.

Our models do not factor in any incumbent wins for the public GCM bus tenders (3 of 12 parcels) or potential rail reform scenarios. We maintain Buy on CD at S$3.76 and SMRT at S$2.32.