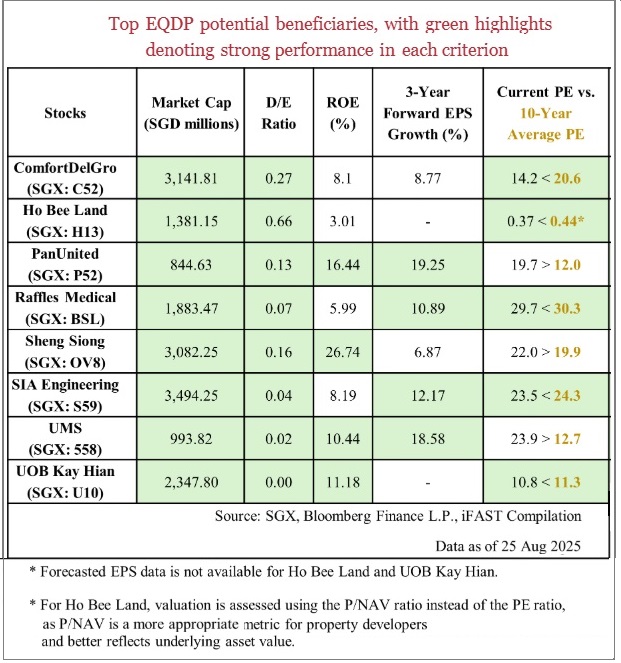

| Singapore’s stock scene is getting a much-needed boost, thanks to the Monetary Authority of Singapore’s Equity Market Development Programme (EQDP). The iFast Research Team has picked eight companies -- homegrown leaders -- they think could really shine in an article published yesterday. Think of the S$5-billion EQDP as a big injection of energy, pumping liquidity, and aiming to put smaller local stocks back in the spotlight. |

| Meet the Eight Hot Picks |

Let’s run through the standouts, all handpicked for their solid fundamentals and knack for growth by iFast:

Starting with ComfortDelGro: The iFast Research Team calls this one a global transport heavyweight, running over 54,000 vehicles in 13 countries.

They're excited about its 23% jump in 1H2025 operating profit, thanks to better margins and cost smarts.

Recent wins like bus deals in Australia and the Stockholm Metro are boosting earnings visibility, plus bids for UK and Aussie rail contracts could lock in long-term growth.

Overseas ops make up over half the revenue, adding resilience amid local competition. Aside from buses, ComfortDelgro also operates train services. In Singapore, SBS Transit, a 74.4% subsidiary of ComfortDelGro, operates the North-East MRT Line and the Downtown Line. Photo: Company

Aside from buses, ComfortDelgro also operates train services. In Singapore, SBS Transit, a 74.4% subsidiary of ComfortDelGro, operates the North-East MRT Line and the Downtown Line. Photo: Company

Next, Ho Bee Land: This property developer's got a luxe portfolio in Singapore, like The Metropolis, plus overseas spots.

Its net profit surged to SGD 49.8 million in 1H2025 from resilient rentals and lower finance costs.

With 95%+ occupancy, it's undervalued at 0.37 P/NAV—perfect for EQDP to shine a light on these hidden property stars.

PanUnited: As a top player in carbon-mineralized concrete, the iFast Research Team loves its eco-edge aligning with Singapore's Green Plan 2030.

With construction demand projected at SGD 39-46 billion yearly through 2029, mega-projects like Changi T5 and Tuas Port spell strong revenue.

It's poised for green leadership and better pricing power.

Raffles Medical: Singapore's big homegrown healthcare outfit operates in 14 cities across five countries.

It reported a 55% profit rise in 1H2025, fueled by domestic strength and China expansions via Shanghai and Chongqing partnerships. This ties into China's "Healthy China 2030," boosting regional growth.

Sheng Siong: Third-largest supermarket chain with 82 value-focused stores.

It had 7.1% revenue growth in 1H2025 and 0.7% margin gains from smarter sales mixes.

Amid uncertainties, automation and new store bids keep it efficient and expanding.

SIA Engineering: A MRO leader serving 80+ carriers worldwide.

It experienced 33.4% revenue growth in Q1 FY2026 from booming demand.

New hangars in Malaysia and Cambodia ventures are set to amp up operations by year-end.

UMS: Precision engineering for semiconductors and aerospace. It reported a 14% revenue and 6% profit bumps in 1H2025, plus expanding margins.

Penang facilities tap into chip rebounds and supply shifts to Southeast Asia, justifying its 24x PE, nearly double its 10-year average.

Finally, UOB Kay Hian: Asia's brokerage giant with regional muscle and a well-established research franchise.

It enjoyed 24.5% income growth in 1H2025 from trading spikes, especially in small-caps rallying post-EQDP launch.

It's geared for higher volumes in volatile times.

| How the 8 have done year to date |

|

Stock Name |

Current Price |

YTD Gain |

|

ComfortDelGro |

1.45 |

-2.0 |

|

Ho Bee Land |

2.08 |

13.7 |

|

PanUnited |

1.17 |

110.8 |

|

Raffles Medical |

1.01 |

18.8 |

|

Sheng Siong |

2.06 |

25.6 |

|

SIA Engineering |

3.12 |

31.7 |

|

UMS |

1.38 |

34.0 |

|

UOB Kay Hian |

2.38 |

41.7 |

Source: Yahoo!

See also: The 4 Undervalued Stocks AGT Partners Recently Scooped Up -- From Property To Vessel Operator