Excerpts from analysts' reports

DBS Vickers says Soilbuild Business Space REIT "a worthy challenger to the big boys"

Analyst: Derek Tan

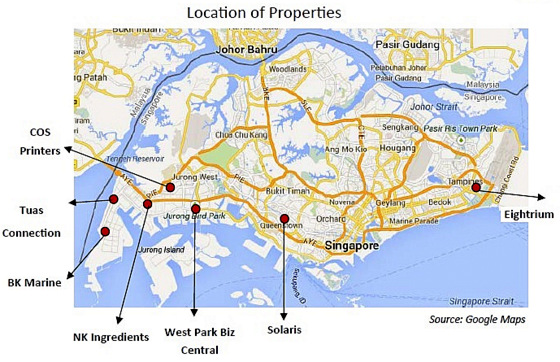

Quality portfolio with unique competitive strengths. Soilbuild Business Space REIT (“SB REIT”) offers exposure into a modern portfolio of business park/industrial properties in Singapore with a valuation of S$935m.

Quality portfolio with unique competitive strengths. Soilbuild Business Space REIT (“SB REIT”) offers exposure into a modern portfolio of business park/industrial properties in Singapore with a valuation of S$935m. Compared to existing industrial S-REITs, its portfolio is the youngest, with an average age of 3.1 years (by GFA), backed by long land lease tenure of c.51 years.

SB REIT will derive 42-43% of its net property income from master leases, with tenures ranging from 5-15 years, and this will offer strong income visibility to the REIT.

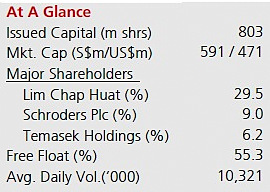

Soilbuild Group MD Lim Chap Huat owns 29.5% of Soilbuild REIT.High exposure to the business park space. At 43.2% of asset value, SB REIT will have one of the highest exposures in the business park space segment (peers have approximate exposure ranging from 7.9%-20.6% of value), which we believe will remain relevant in the face of Singapore’s growth towards a knowledge-based, value-add manufacturing economy. This augurs well for the performance of the portfolio in the medium term.

Soilbuild Group MD Lim Chap Huat owns 29.5% of Soilbuild REIT.High exposure to the business park space. At 43.2% of asset value, SB REIT will have one of the highest exposures in the business park space segment (peers have approximate exposure ranging from 7.9%-20.6% of value), which we believe will remain relevant in the face of Singapore’s growth towards a knowledge-based, value-add manufacturing economy. This augurs well for the performance of the portfolio in the medium term. Reputable Sponsor with visible inorganic growth pipeline. The Sponsor is Soilbuild Group Holdings Ltd. (“Sponsor”), a leading property group with end-to-end integrated real estate capabilities.

Soilbuild's Eightrium: an eight-storey east wing and a six-storey west wing interlinked by a five-storey atrium, located within Changi Business Park. The Sponsor has given SB REIT a right of first refusal (ROFR), which currently covers four industrial properties. When acquired and developed completely, the ROFR properties possess the potential to increase the REIT’s GFA by 72%. In addition, SB REIT can extract a further 0.8m sq ft (25% of current GFA) through maximising unutilized GFA from its portfolio.

Soilbuild's Eightrium: an eight-storey east wing and a six-storey west wing interlinked by a five-storey atrium, located within Changi Business Park. The Sponsor has given SB REIT a right of first refusal (ROFR), which currently covers four industrial properties. When acquired and developed completely, the ROFR properties possess the potential to increase the REIT’s GFA by 72%. In addition, SB REIT can extract a further 0.8m sq ft (25% of current GFA) through maximising unutilized GFA from its portfolio. Initiate with BUY, TP S$0.87. At a FYP13F-15F yield of 7.8%-8.7%, SB REIT offers one of the highest yields amongst the S-REIT space, which is attractive. Our DCF TP of S$0.87 implies a total return of 24%.

AmFraser has target price of 83 cents

Analyst: Eileen Goh

We initiate coverage on Soilbuild Business Space REIT with a BUY recommendation and a target price of S$0.83.

Analyst: Eileen Goh

We initiate coverage on Soilbuild Business Space REIT with a BUY recommendation and a target price of S$0.83.

Soilbuild REIT is a Singapore real estate investment trust that comprises two business park assets and five light industrial properties. Distributions are on a quarterly basis and the first DPU is expected to be distributed on or

before 27 Feb 2014.

Our valuation is derived from a dividend discount model, that incorporates an assumed cost of equity of 7.8%.

Current projected yield of 8.3% is highest among the industrial S‐REITs and represents an attractive yield spread of 570 basis points over the risk‐free rate.

Soilbuild REIT's powerpoint presentation materials are available on SGX website.

Read also: OCBC says Soilbuild Business Space REIT is "best proxy to Singapore industrial market"

Current projected yield of 8.3% is highest among the industrial S‐REITs and represents an attractive yield spread of 570 basis points over the risk‐free rate.

Soilbuild REIT's powerpoint presentation materials are available on SGX website.

Read also: OCBC says Soilbuild Business Space REIT is "best proxy to Singapore industrial market"