OCBC maintains 'sell' call and 77-c target price on BreadTalk

Analyst: Lim Siyi

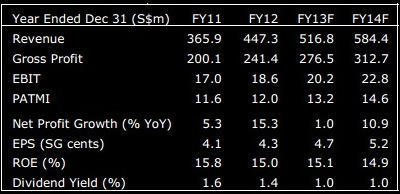

With BreadTalk’s share price seemingly poised to cross the S$1 barrier again, we remain steadfast in our analysis and assertion that valuations are stretched at current levels.

With BreadTalk’s share price seemingly poised to cross the S$1 barrier again, we remain steadfast in our analysis and assertion that valuations are stretched at current levels. While the group’s growth proposition appears attractive, realizing future potential takes time, and more importantly, carries significant operating and execution risks.

Its operating margins have also remained in the low single-digit region.

Furthermore, the group’s valuation is expensive when compared to more established regional peers that compete in the same markets.

We maintain our SELL rating with an unchanged fair value at S$0.77, and will look to re-rate the stock only when its margins arrest their decline and operations approach a steady-state.

A takeover angle at this juncture is also unlikely as we do not envision MINT launching a takeover bid anytime soon in the coming quarters at current price levels.

Full OCBC report here.

OCBC says Soilbuild Business Space REIT is "best proxy to Singapore industrial market"

Analyst: Kevin Tan

Soilbuild's Eightrium: an eight-storey east wing and a six-storey west wing interlinked by a five-storey atrium, located within Changi Business Park.We are initiating coverage on Soilbuild Business Space REIT (Soilbuild REIT) with a BUY rating.

Soilbuild's Eightrium: an eight-storey east wing and a six-storey west wing interlinked by a five-storey atrium, located within Changi Business Park.We are initiating coverage on Soilbuild Business Space REIT (Soilbuild REIT) with a BUY rating. Soilbuild REIT currently owns a young portfolio of seven modern business space properties in Singapore and has the largest exposure to the business park segment.

We like Soilbuild REIT’s exposure in this space because demand in the local scene has been growing steadily throughout the years. We also believe that Soilbuild REIT is able to leverage on the capabilities of its Sponsor, Soilbuild Group, to grow its income given its track record and expertise.

Soilbuild REIT is granted Right of First Refusal (ROFR) by its Sponsor over all its income-producing business space assets in Singapore.

The ROFR currently covers four industrial properties, providing Soilbuild REIT with a clear acquisition pipeline.

As of the listing date, Soilbuild REIT is sitting at healthy gearing ratio of 29.9%, while 75.0% of its interest rates are fixed.

This not only gives Soilbuild REIT ample debt headroom to pursue its growth plans but also limits its exposure to rising interest costs.

Our fair value of S$0.82 implies an attractive total expected return of 20.1%.

At current price, Soilbuild REIT is also trading at the steepest discount of 8.8% to its book value, compared to its subsector peers. This is unjustified in our view given Soilbuild REIT’s quality portfolio assets, growth potential and respectable FY14F yield of 7.8%.