Translated by Andrew Vanburen from a Chinese-language piece in Beijing Business Today

IF SIZE DOES indeed matter, then having the bulk of your money in big firms should bring a sense of security, right?

So which large-cap A-share firms in China – if any -- are the best bets for those seeking stable growth without a lot of anxiety?

Let's first look at a couple prime examples of blue chips that are singing the blues lately.

Two major earth moving powerhouses in China are doing a lot of moving and shaking, but not the kind that inspires confidence in shareholders.

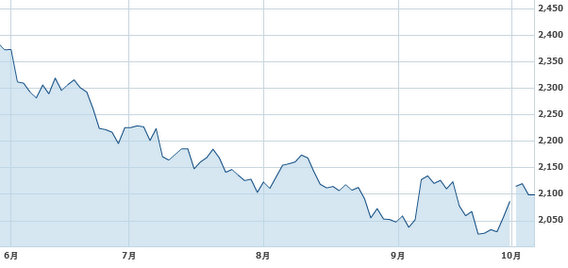

XuGong Science & Technology Co Ltd (SZA 000425) and Sany Heavy Industry Co Ltd (SHA:600031

These two industrial behemoths are not alone in bringing gloom and disappointment to investors in China’s large-cap A-shares in both Shanghai and Shenzhen.

In fact, XuGong is not only having trouble attracting new investors these days, but US-based Carlyle's bid for a sizeable stake in the group was chased away by rising economic nationalism and protectionism five years ago.

In fact, for most investors with sizeable portfolios, very few have managed to completely avoid at least an appreciable exposure to the blue chip firms that by definition make up the lion’s share of both the benchmark index’s members as well as the overall equity market’s capitalization.

Generally speaking, for blue chip A-share investors of any degree, the ones suffering the least are those who got into the game the most recently, because they were almost certainly paying bargain basement entry-level buy-in fees given the steadily declining share prices of large caps over the past several quarters.

Are there any exceptions?

Are large-caps to be completely avoided? Or are some genuine bargains with legitimate long-term growth potential still out there for the taking?

And for the large body of underperforming blue chips, shouldn't management be as ashamed of the firm’s share price performance as its shareholders are miserable?

Perhaps this is where the recovery should start – re-instilling a sense of both pride and shame in leading executives of listed enterprises when their firms' share prices soar to new heights – or plummet to new nadirs.

We all remember quite clearly over the past few years how Chairmen and CEOs would often tout their blue chip shares as the best guarantees in the market of steady, stable growth, consistent returns and reliable dividend policies.

But experience has shown us that since the global financial meltdown four years ago, there are no “safe bets” in the market, and even A-share blue chips with established names and solid business plans cannot truly guarantee anything resembling slow and steady returns on investment these days.

The danger is of course for investors who put most of their eggs in the blue chip basket at an early stage, and have seen a lot of share value erode over time.

It is hardest for this category of investor to completely pull up their stakes, fold the tent, and exit the market.

But an even bigger danger is for the listed firms themselves.

Unless they start finding ways to beef up business and boost share prices, they will have increasingly contentious AGMs to deal with.

But more importantly, they will be hard pressed to convince any newcomers to throw their lot in with them.

After all, blue chips shouldn’t feel “entitled” to shareholder interest or enthusiasm.

There are hundreds upon hundreds of lesser-known SME newcomers struggling for recognition, and if the blue chips continue to disappoint, investors will naturally flock to the field of smaller startups looking for potential winners.

And there are always bonds, bullion and good old fashioned savings accounts out there competing for attention with the large caps.

One can only hope that blue chips turn things around and help chase away the market blues – because a benchmark index populated by no-name SMEs would be a bizarre phenomenon indeed.

See also:

PARTY TIME: Top Five PRC Earners

POINTING FINGERS: ‘Immature’ Investors At Fault In China?

ONE MAN’S TRASH... Time To Look At ‘Garbage’ A-Shares?

CHINA CONSENSUS: Things Are Looking Up