Ang Hao Yao, 39, is a full-time value investor who has a Master’s in Business Administration and Chartered Financial Analyst certification.

Photos courtesy of Ang Hao Yao

Photos courtesy of Ang Hao Yao

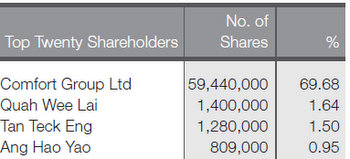

Hao Yao is listed as No. 4 largest shareholder in this snapshot from Vicom's 2007 annual report.

Vicom appeared to be a dull stock -- most Singaporeans know Vicom as operating the mundane business of inspecting the road worthiness of vehicles in Singapore.

However, full-time investor Ang Hao Yao analysed its balance sheet, its cashflow and what not -- and thought it was a stock he could bet big on.

Eventually, he accumulated a nearly 1% stake worth over $1 million, and was listed as the No. 4 largest shareholder in the company's 2007 annual report (see snapshot on the top right).

He talked a bit about this stock and his background -- inherited money, married with two children, etc -- in an interview in this article four years ago: ANG HAO YAO: Investing during tough times

Well, four years it has been and we thought it's time to catch up with him, partly because he has reaped rich rewards after Vicom became a multi-bagger stock. Vicom proved to be a gem!

We had a couple of questions and decided to invite questions from three other investors - Calvin Yeo, 'Singapore Blue Chip' and Drizzt - whose articles have appeared on our website, such as:

> Plan to retire at 55? You need at least S$720K (in today's dollars) - by Singapore Blue Chip (aka Cedric Fun)

> The rewards of investing in property - by Calvin Yeo

> NOBLE GROUP: Amazing 9,520% return since start of 2001 - by Drizzt

Aside from delving into his investments, Ang Hao Yao, 39, says he spends just as much time contributing his services to associations and charities.

These are the Sata CommHealth (as Vice Chairman), Singapore Chess Federation (Vice President), Singapore Jian Chuan Tai Chi Chuan Physical Culture Association (Assistant Dean), and Securities Investors Association Singapore (Corporate Governance Committee Member).

NextInsight: The Singapore stock market has rallied -- do you think this is a false start? Have you put fresh money into the market in the last couple of weeks?

Hao Yao: A period of rallying would not be unusual given that 2011 was a bad year for most major stock markets. Whether it can last into the second quarter really depends on the situation in Europe, which is difficult to predict. However, a recovery back of the STI to above 3,000-3,100 this quarter would not surprise me. (The index was at around 2,900 points at the point of writing)

NextInsight: What were the key things you did (investing-wise) in 2011?

Hao Yao: 2011 was an unexciting year for me. I reduced my holdings in QAF which I reckon made at least 40-50% return. I increased my stake above 1% of Sing Investment and Finance and Elite KSB. I also bought some property stocks after they took a hit from the latest property measures. In 2012, I added WBL to my portfolio as the company is involved in a number of interesting businesses. Most of my other stocks are held for dividends.

NextInsight: What was your % return on capital in 2011?

Hao Yao: I estimate a loss of around 3.5% after personal expenses. So far, January 2012 has been good and I should have made most of that back.

Cedric Fun: Analysts are betting their last dollar that housing prices will fall between 15%-35% when massive supply comes in. What are your thoughts on this?

Ang Hao Yao at the Maritime Experiential Museum & Aquarium in Resorts World Sentosa recently.

Cedric Fun: At current high price levels, do you think investors should no longer dabble in property?

Hao Yao: Dabbling is to do something as a secondary activity or superficially. I don't think anyone should dabble in any class of investment.

Rather, investors should spend time and effort to understand the investment and to take a long term view of that asset class rather than getting involved intermittently.

As for current high price levels, I wouldn’t sell my home because there is always a risk that it would appreciate further and even beyond my reach.

However, anecdotally I have noticed more ‘For Sale’ and ‘For Rent’ signs in my neighborhood, and that means the time will come for good bargains in property.

Calvin Yeo: In a previous article, you said you had one main holding, Vicom. Was it more than 50% of your total stock holding? If so, were you not well diversified enough? Do you still hold Vicom?

Hao Yao: It was a unique period in early 2008. I was convinced the market was too high given the problems the US banks were facing, so I sold as many investments as I could and was left with one major holding -- a 1% stake in Vicom, which made up most of my equity portfolio.

However, I didn’t feel that was too risky as I had other asset classes like property, cash, foreign currencies and gold. I have since sold off Vicom as it has more than doubled over 2-3 years. My cost for most of it was under 70 cents and I can't bring myself to buy it now at around $3.80.

Calvin Yeo: Do you have any bond holdings? I understand that most full time investors would have bonds as part of a total asset allocation strategy.

Calvin Yeo: Do you have any bond holdings? I understand that most full time investors would have bonds as part of a total asset allocation strategy.

Hao Yao: I don’t find the yield for investment grade bonds to be attractive as the interest rates for major currencies are very low. And I think the skill set and knowledge required for investing in bonds are somewhat different from those for stocks. To diversify as part of a total asset allocation strategy is only as useful as your skills in the various asset classes you diversify into.

However, anecdotally I have noticed more ‘For Sale’ and ‘For Rent’ signs in my neighborhood, and that means the time will come for good bargains in property.

Calvin Yeo: In a previous article, you said you had one main holding, Vicom. Was it more than 50% of your total stock holding? If so, were you not well diversified enough? Do you still hold Vicom?

Hao Yao: It was a unique period in early 2008. I was convinced the market was too high given the problems the US banks were facing, so I sold as many investments as I could and was left with one major holding -- a 1% stake in Vicom, which made up most of my equity portfolio.

However, I didn’t feel that was too risky as I had other asset classes like property, cash, foreign currencies and gold. I have since sold off Vicom as it has more than doubled over 2-3 years. My cost for most of it was under 70 cents and I can't bring myself to buy it now at around $3.80.

Hao Yao: I don’t find the yield for investment grade bonds to be attractive as the interest rates for major currencies are very low. And I think the skill set and knowledge required for investing in bonds are somewhat different from those for stocks. To diversify as part of a total asset allocation strategy is only as useful as your skills in the various asset classes you diversify into.

Calvin Yeo: Does it appear that you invest in mainly small caps? Do you take an active approach by meeting the management of the companies? Also, do you envision yourself becoming an activist shareholder at some point in time?

Hao Yao: I currently buy mostly small and medium cap companies as big caps are already well covered by analysts and fund managers. I try to meet the management at least once to get a feel of the company’s potential.

I'm not sure how you classify an investor as an activist shareholder. I typically read about a company, try to attend its AGM and ask questions or give comments. If I felt that a company had many flaws or were doing things poorly, I would not invest in it in the first place. However if a situation came up in one of my investments that I feel the minority shareholders have to come together to act, then I would also have to raise my level of activism accordingly.

Hao Yao: Well, clearly those are ideal characteristics to have for any investment. Importantly, the company must also have growth potential as well as a strong team of executives managing it. Next question to consider would be at what valuation would you pay for such a company as typically, their PEs are pretty high.

Drizzt: Are there stocks that you like on the SGX but they have yet to come down to attractive valuations? Could you provide a couple of examples?

Related story: VICOM: A rare 5-bagger in 5 years but....Would you buy it now?

thanks for providing these kinds of statistics.