CAPITAL: CHU KONG 'full of orders'

Chu Kong Petroleum and Natural Gas Steel Pipe (HK: 1938; PCK) is the largest steel pipe manufacturer in China in terms of production volume of longitudinal submerged arc welded (“LSAW”) steel pipes.

“In 2010, it was a hard time for the company. However, its operating environment is improving in 2011. Our recent visit indicated that the production capacity of the company has been fully utilized until 1H12," said Capital.

“With its cost-plus business model, PCK will be less impacted by rising raw material prices.”

The brokerage visited the factory base of PCK in Panyu and the factory base under construction in Zhuhai last month.

“In Panyu, we saw that all of its production lines were fully utilized. According to the management and the factory head, the production plan has been queued until 1H12. We also visited the factory construction site located in Zhuhai.

"According to the general manager of the Zhuhai factory, the plant can start its production in late 2011. The construction site we visited is only part of its factory plants in Zhuhai, and there is another larger area which is few kilometres away from current construction base and closer to CNOOC – PCK’s top client.”

PCK received new orders of approximately 186k tonnes in 3Q2011, and total orders reached 755,000 tonnes as at 3Q11.

“According to management, the production capacity has been fully utilized until 1H12. In 3Q11, the company received re-order from Columbia Gas Project and won the bid of Guangdong Natural Gas Pipe Network II, amounted USD73 million and RMB382 million, respectively,” Capital said.

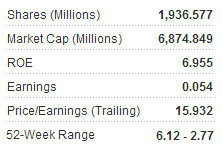

After the company released its order book status, Capital said it adjusted its projections for the company.

“The ASP of steel pipe is adjusted downward while the production is adjusted upward due to the increased capacity in Zhuhai, Lianyungang and Saudi Arabia. We use DCF-based methodology to calculate the target price of PCK. The assumptions are: i) market risk premium of 10.0%, ii) beta of 1.4, iii) after-tax cost of debt of 6%, iv) WACC of 12.8%.

“Based on these assumptions, the target price of PCK is HK$3.22, implying a potential upside of 83%. We reiterate the rating 'Strong Buy' for PCK.”

See also: CHINA MID-CAPS Get Big Boost; Premier Wen Urges Credit Flexibility

BOCOM: PACIFIC BASIN SHIPPING riding market rebound

Bocom International said Pacific Basin Shipping (HK: 2343) is benefitting from the latest market rebound.

Stronger than anticipated freight rate improvement “Management of Pacific Basin (PB) highlighted that market freight rates for Handysize and Handymax bulk carriers have increased 12% and 22%, respectively, since 30 June,” Bocom said.

Management expects a healthy supply-demand balance for minor bulk carriers segment in 2012 overall on the back of reduced newbuilding deliveries, high scrapping levels and sustained dry bulk demand, the brokerage added.

See also:

COURAGE MARINE, COSCO PACIFIC: Challenging 1H For Shippers

China IR Firm BlueFocus Nearly Triples Its 3Q Revenue