|

Several Singaporean investors were recently holidaying in Changsha city in the Chinese province of Hunan when they knocked on the door of a Singapore listco to catch up on the company's business. |

Anchun has just reported some decent numbers for 1HFY2025.

|

Metrics (RMB million, unless stated) |

FY2023 |

FY2024 |

1HFY2025 |

|

Revenue |

133.6 |

177.4 |

71.6 |

|

Gross Profit (Margin %) |

30.7 (23.0%) |

41.2 (23.2%) |

16.8 (23.5%) |

|

Net Profit Attributable to Owners |

2.4 |

10.9 |

4.7 |

|

EPS (RMB cents) |

5.06 |

23.43 |

9.93 |

Putting this in perspective, it's riding a wave from FY2024, where full-year sales jumped 33% to RMB177.4 million.

FY2023's revenue dipped to RMB133.6 million (-27% from FY2022's RMB182.8 million).

Back in FY2023, things were rough with supply chain hiccups post-COVID and weak demand.

Anchun achieved strong 1H2025 contract wins amounting to RMB 121 million, which is a very strong half considering their revenue track record.

Anchun said it has RMB179.3 million worth of backlog (up from FY2024's RMB130.0 million) to be recognised as follows:

- FY2025 (second half): RMB58.55 million.

- FY2026: RMB120.76 million.

| Cash, lots of it |

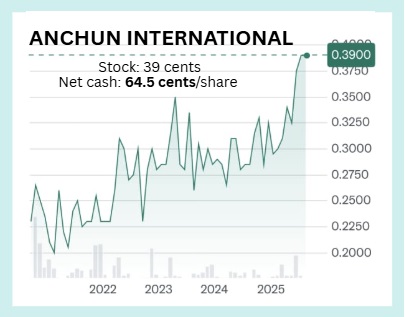

Anchun's eye-catching feature is its cash per share (with zero debt) exceeding its stock price (39 SGD cents) by a wide margin.

Anchun's net cash stash of RMB163.6 million (about SGD29.1 million at today's rates) is bigger than its market cap of SGD18.3 million as of August 12, 2025.

That means the market's slapping a negative tag on the actual business.

Unfortunately, it's nothing new -- its net cash has exceeded its market cap for many years, although the stock has slowly re-rated (see chart above).

It's up 20% year-to-date (from 32.5 cents to 39 cents).

|

Per share (SGD cents) |

FY2023 |

FY2024 |

1HFY2025 |

|

Net Cash |

70.6 |

77.7 |

64.5 |

|

Net Asset Value |

118.1 |

122.3 |

122.0 |

| Dividend | -- | 2.15 | -- |

This cashpile has opened doors for juicy dividends (irregular), buybacks, and raised the possibility of going private.

On the flip side, the stock's super illiquid – in the past 3 months, average daily trades around 11,000 shares (worth ~SGD4,300).

Why? It's a tiny cap, not much love from funds, and that niche China chemical focus is not familiar ground for Singapore investors.

Anchun's trading at a trailing P/E of about 9x (on FY2024 EPS of 4.2 SGD cents) but, as mentioned above, its cash of 64.5 SGD cents/share means its profitable business has been accorded zero value -- in fact, it has been given a negative value. All in all, 1HFY2025 keeps the rebound going from FY2023's slump. This could sound alluring, just as are Changsha's spicy delights. Anchun is a little-followed microcap — cash-rich, profitable, and with a growing order book — hiding in plain sight on the SGX. |

For more, see Q&A between SIAS and Anchun ahead of the FY2024 AGM here.