Excerpts from latest analyst reports….

Analyst: Eric Ong

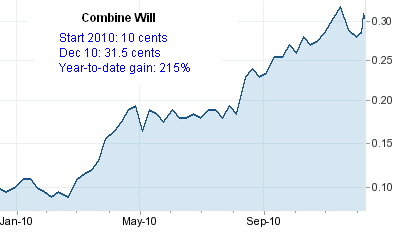

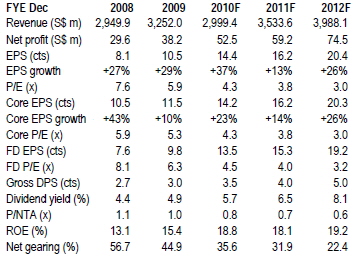

Impressive 9M10 results. Combine Will’s net profit for January‐September surged almost 152% YoY to HK$68.9m on the back of a 62% YoY growth in revenue. This was mainly driven by its ODM/OEM business segment, thanks in part to the launch of a new product (automatic liquid‐soap dispenser) and effective cost controls at the operational level.

Top three automobile moulds manufacturer in China. Besides supplying moulds for its own ODM/OEM business, Combine Will also makes moulds for external parties.

Notably, the group is an approved supplier to automobile part manufacturers that service established car makers such as Honda, Volvo and General Motors. It is also included in the accredited list of automotive Tier One suppliers to Valeo, Delphi and Faurecia. About 60% of its mould business comes from the automobile industry.

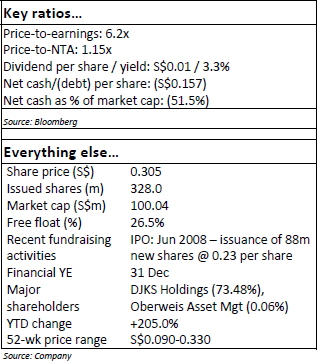

Growth momentum to continue. The stock currently trades at consensus 6.2x FY10 and 5.1x FY11 PER, which appears undemanding. Key risks are expected RMB appreciation and rising labour costs in China.

Recent story: COMBINE WILL Eyeing "Fairer Value" In Korea Listing

CIMB says Combine Will and ECS are cheap....

The share price of ECS's Hong Kong-listed competitor, Digital China, is a case in point, jumping to a record high as the completion of its TDR listing drew near. Digital China now trades almost on par with Taiwanese competitor, Synnex’s 14x CY12 P/E. ECS, on the other hand, is still trading below 4x CY12 P/E.