|

DR LIN YUCHENG has reason to be delighted with his company's just-announced Q3 results but he is not thrilled that United Envirotech’s shares still trade at a sharp discount to its peers.

Over lunch with analysts last Thursday, Dr Lin, the chairman and CEO of United Envirotech, brought up his observation that the market was according his peers a much higher valuation.

Over time, the market could re-rate his stock - if United Envirotech continues to deliver handsome earnings growth.

There is a piece of public information that seems to point towards that happy outcome: United Envirotech has an order book of S$140 million for its industrial wastewater treatment projects that would be recognized over the next 18 months.

That works out to an average of S$23.3 million per quarter, which is a significant increase as a back-of-the-envelope calculation shows.

| RISING QUARTERLY REVENUE, RISING PROFIT | |||||||||||||||||

|

Assuming Q4 (ending March 2010) sees revenue of S$23.3 million, the total revenue for the current FY 10 would be S$62.2 million (ie, S$38.9 m for the first 9 months + $23.3 m).

That is a 45% jump from the $42.9 million for the previous financial year.

Assuming the next financial year has S$23.3 million multiplied by 4 quarters in revenue, one would get $93.2 million, which would be an increase of 50% year-on-year.

Here the assumption is that United Envirotech does not enjoy any contribution from any new contract that it may get from now on.

That assumption is very conservative. Take a look at CIMB-GK’s forecast in a report on Jan 20 this year, as follows:

|

|||||||||||||||||||||||||||||||||||||||||||||||||

In his Jan 20 report, CIMB-GK analyst Gary Ng forecasts far higher revenue for even this current financial year and for the next.

He has a target price of S$0.56, reflecting FY11 earnings, and 10x earnings multiple.

This is still below the mid-cycle valuation, and is at a discount to bigger peers who were re-rated upon awards of overseas contracts (e.g. Epure, Hyflux).

”We like UENV for its projects visibility in the municipal sector, and its proven execution in overseas projects," wrote Gary.

The company offers "excellent value" trading at 6.1x FY11 P/E against its 3-year core earnings CAGR forecast of 37%, according to him.

At the time of the report, the stock price was 34 cents, much higher than the 27 cents it closed at last Friday, pulled down by the overall market downturn.

Now, let's look at several highlights from the recent Q3 (Oct-Dec 09) results of United Envirotech, which operates in a niche servicing petrochemical giants such as Sinopec, CNOOC, and CNPC in China:

* Cash and cash balances stood at S$43.4 million. The company is in a net cash position.

* Net cash used in operating activities was $9.1 million (ie, there was a net outflow), mainly attributable to a $20 million tender deposit placed for a project. The money has since been returned to the company after Dec 31.

* Revenue stood at $18.8 m, which was 114.3% higher year-on-year.

* Net profit was $5.2 million, which was 383.6% higher year-on-year.

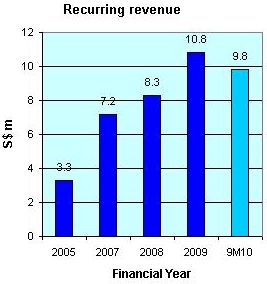

* Recurring revenue for treatment of wastewater at 5 projects that it maintains rose by $1 million, to $3.6 million, as a result of higher capacity of wastewater treated. United Envirotech's recurring revenue has been climbing over the years - an interesting trend of assured revenue, which could lead the company to spin off the water treatment business as a water trust.

Our previous report had more on the business of United Envirotech, which is building China’s biggest municipal wastewater project using membrane bioreactor (MBR) technology in Guangdong province. The value of the project is estimated to be Rmb240m.