| Sharebuyback | Date of purchase | No. of shares purchased | Average price/share (S$) | Total value (S$) |

| SGX | 21-08-2008 | 210,000 | 6.18-6.25 | ~1.3 m |

| 20-08-2008 | 100,000 | 6.22-6.27 | ~624,000 | |

| 19-08-2008 | 210,000 | 6.32-6.45 | ~1.3 m | |

| 18-08-2008 | 155,000 | 6.49-6.60 | ~1 m | |

| 15-08-2008 | 155,000 | 6.64-6.59 | ~1 m | |

| 14-08-2008 | 170,000 | 6.66-6.69 | ~1.1 m | |

| 13-08-2008 | 210,000 | 6.66-6.73 | ~1.4 m | |

| 12-08-2008 | 210,000 | 6.69-6.77 | ~1.4 m | |

| 11-08-2008 | 208,000 | 6.75-6.83 | ~1.4 m | |

| 8-08-2008 | 202,000 | 6.71-6.77 | ~1.3 m |

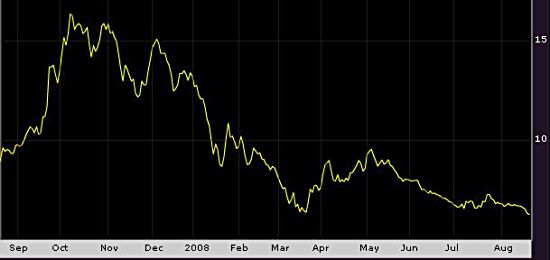

The above share buyback moves come after a long lull: SGX last bought back its shares in November last year. In that instance, it bought back 217,700 shares at between $15.10 and $15.40 each. That's a total of about $3 million.

Here are excerpts from several recent analyst reports regarding SGX's fair values and business fundamentals:

SGX Centre at Boon Tat Street. Photo by Sim Kih

”The average daily trading volume for July was S$1,251m versus S$1,809m in the first half. August is currently averaging S$1,337m and we forecast average volume of S$1,500m for FY09. We do not expect a return to the lows of the previous years as there are significantly more companies listed now with different asset classes that can structurally support better volume than in the past. Volume is, however, expected to be extremely volatile in the near term.”

* Citigroup issued a ‘sell’ call on April 28, when SGX stock was recently at $7.81. “Our S$6.45 target is based on S$1.65 billion/day Average Daily Turnover into FY09. For every S$0.1billion rise in our Average Daily Turnover assumption, target price rises 4.7%.”

* JP Morgan on April 14 maintained an ‘overweight’ rating and Dec-08 price target of $10. SGX’s earnings per share for the Q3 ended March 08 came in at S¢9.48 versus JP Morgan’s estimate of S¢8.94. The

result was above consensus by 11%.

”We are increasing FY08 (June end) estimate by 7.9% as we factor in S$1.9 billion of average

* Goldman Sachs on April 15 had a ‘neutral rating’: “We have raised our 12-m target price to S$8.6 (22X calendar 2008E EPS) from S$8.2. We have also set a “suggested entry level” at S$6.3, based on 18X our worst-case EPS estimate (assuming S$1.6 bn daily stock turnover).”

* Merrill Lynch on April 15 issued a ‘sell’ call: “SGX remains expensive, in our view, trading at 21x 08E PER and 10x P/BV. Deciding on the level at which to buy SGX feels much like an attempt to catch aproverbial knife. We would suggest waiting until the street turns bearish on the outlook for trading volumes. ML’s fair value for SGX is unchanged at S$5/share.”

SGX stock recently traded at $6.28