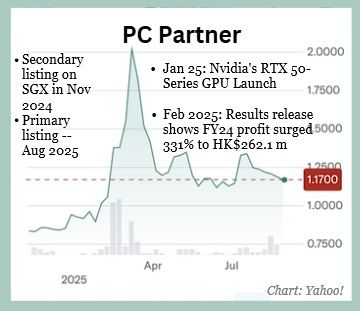

Founded in 1997, PC Partner Group, which has recently achieved a primary listing on the Singapore Exchange, is a long-time player in the computer electronics space.

Its star products are video graphics array (VGA) cards, which make up the bulk of its business—over 90% of revenue in 1HFY25. PC Partner, whose other products are motherboards and mini-PCs, is one-of-a-kind business on the SGX. Its VGA cards are essentially the brains behind stunning visuals in gaming PCs and AI applications. Notably, the VGA cards incorporate GPUs from the world's biggest GPU (graphics processing units) producer Nvidia, its major supplier.  At the COMPUTEX 2025 show in Taipei in May 2025, Jensen Huang, CEO of Nvidia, dropped by the booth of Zotac, a brand of PC Partner. Nvidia is a major GPU supplier to PC Partner. Photo: Zotac At the COMPUTEX 2025 show in Taipei in May 2025, Jensen Huang, CEO of Nvidia, dropped by the booth of Zotac, a brand of PC Partner. Nvidia is a major GPU supplier to PC Partner. Photo: Zotac Jensen Huang's autograph on a Zotac flagship product. Photo: Zotac Jensen Huang's autograph on a Zotac flagship product. Photo: ZotacPC Partner sells under its own brands like Zotac and Manli, as well as through ODM/OEM channels for other companies. Brand graphics cards were the star, with volumes and prices spiking thanks to Nvidia's 50-series launches like the RTX 5090. PC Partner also provides electronics manufacturing services (EMS, where it builds products for others) and works as an original equipment manufacturer (OEM) or original design manufacturer (ODM), creating items sold under other brands.

|

||||||||||||||||

PC Partner's 1HFY25 numbers show robust growth amid a ramp in production in its new Batam facility, which helps PC Partner minimize risks tied to US-China tensions and chip export restrictions, especially concerning critical suppliers like Nvidia.

See details in the table:

|

(HK$ m) |

1HFY25 |

1HFY24 |

Change |

|

Revenue |

6,355.3 |

4,944.2 |

28.5% |

|

Gross profit |

669.5 |

558.4 |

19.9% |

|

Gross profit % |

10.5% |

11.3% |

-7.1% |

|

Profit attributable to owners |

250.4 |

194.1 |

29.0% |

|

Interim dividend |

HK$0.25 |

HK$0.20 |

25% |

| Dividend payout ratio | 38.8% | 40% |

Revenue surged 28.5% driven mainly by a 41.1% jump in VGA card sales.

Own-brand VGA cards skyrocketed 62.1% with 1.3 million units sold—nearing pandemic-era peak.

See details in the table:

|

HK$ m |

1HFY25 |

1HFY24 |

Change |

|

VGA Cards |

5,770.3 |

4,088.7 |

+41.1% |

|

- Own Brand VGA Cards |

4,917.0 |

3,033.3 |

+62.1% |

|

- ODM/OEM VGA Cards |

853.3 |

1,055.4 |

-19.1% |

|

EMS |

294.6 |

346.0 |

-14.9% |

|

Other PC-related products and components |

290.4 |

509.5 |

-43.0% |

The balance sheet looks solid too: cash and bank balances stood at HK$2,136.7 million, despite higher inventories (up to HK$1,608.4 million) to meet demand.

Borrowings increased to HK$1,100.5 million, but net assets grew to HK$3,063.9 million.

Geographically, growth was widespread: APAC up 17.6%, North and Latin America 44.9%, PRC 24.3%, and Europe/Middle East/Africa/India a whopping 45.8%.

With factories in Dongguan, China and now Batam, this diversification underscores their global reach in a market hungry for gaming tech.

| Boost from AI and gaming boom |

Looking ahead, PC Partner's outlook is fueled by the AI boom and gaming resurgence.

| Key growth drivers in 1HFY25 |

• Strong demand of the RTX 50 Series VGA Cards launched in 1HFY2025 • PC Partner secured the latest top-of-the-line RTX 5090 GPU after relocating its HQ and achieving secondary listing on the SGX-ST in Nov 2024. • This, in turn, resulted in a strong rebound in sales of own-brand VGAs. |

The VGA segment's strength ties directly to partners, especially Nvidia, which is its key supplier of GPUs.

Challenges like supply chain volatility and competition persist, especially for entry-level VGAs.

The 2HFY25 is expected to see continued success of graphics cards following the Nvidia's RTX 50 series launched in 1H.

These GPUs promise massive AI enhancements, improved ray tracing for lifelike graphics, and better energy efficiency—ideal for gamers, creators, and AI workloads.

One strategic move worth noting: PC Partner has converted its secondary listing on the SGX to a primary one, and will seek shareholder approval at an EGM to delist from Hong Kong Stock Exchange -- likely before end-2025. One strategic move worth noting: PC Partner has converted its secondary listing on the SGX to a primary one, and will seek shareholder approval at an EGM to delist from Hong Kong Stock Exchange -- likely before end-2025.This is to diversify beyond Greater China, attract more international investors, and potentially secure better supply chains—especially GPUs from Nvidia amid geopolitical tensions. PC Partner’s VGA Card business, driven by its own brands, has been a major growth engine.

|

PC Partner's 1HFY25 Powerpoint deck is here.