• There is a Singapore peer of UMS Integration, Grand Venture Technology and Frencken that is much smaller but growing fast -- Metasurface Technologies.

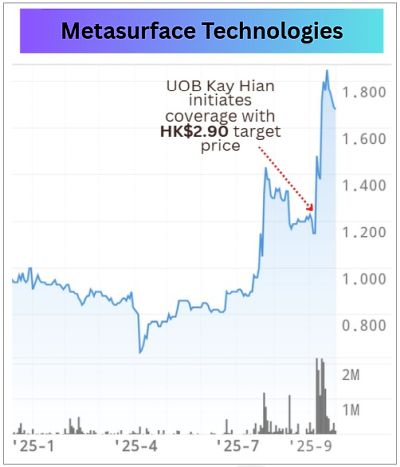

• It primarily serves the semiconductor, aerospace, and data storage industries, offering comprehensive build-to-print precision engineering services. • Since its IPO, Metasurface's stock has performed dismally -- until this month. It touched an intra-day high of HK$1.93 but retraced to HK$1.68 yesterday (22 Sept). • A couple of developments ignited investor interest:

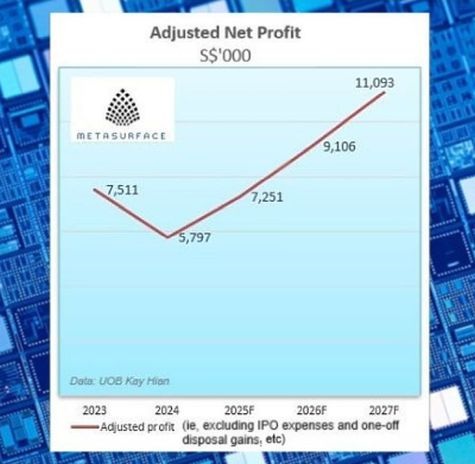

UOBKH's profit forecast of Metasurface profits UOBKH's profit forecast of Metasurface profits |

Here's a comparison of Metasurface with its peers big and small:

|

Company |

Stock Price |

Market Cap |

P/E |

Revenue |

Net Profit |

Dividend Yield |

|

Metasurface Technologies |

HK$1.72 |

HK$258 m |

10.1 |

S$43.9 m |

S$4.2 m |

- |

|

JEP Holdings* |

S$0.26 |

S$107 m |

26.0 |

S$56.9 m |

S$3.7 m |

- |

|

UMS Integration |

S$1.32 |

S$951 m |

22.9 |

S$257.2 m |

S$41.6 m |

3.7% |

|

Frencken Group |

S$1.40 |

S$598 m |

15.6 |

S$853.0 m |

S$38.9 m |

1.9% |

Notably, JEP has the highest historical PE of 26, surpassing even that of UMS which is its majority shareholder.

• OK, now read UOB KH's take on Metasurface Technologies ....

Excerpts from UOB KH report

Analysts: Johnny Yum & Colin Lee

Initiate Coverage • Core precision engineering service provider. Metasurface Technologies Holdings (Metasurface) is a build-to-print precision engineering service provider headquartered in Singapore, specialising in the production of large format precision components primarily for the semiconductor equipment and aerospace industries. • Set to benefit from robust investment in semi supply chain. As chip fabrication in advanced nodes for memory and logic has grown in complexity, more processing steps are required for every generation of chips due to the introduction of additional mask layers, multi-patterning cycles, metrology and inspection. As a result, more time is also required to fabricate wafers, necessitating the procurement of more wafer fabrication equipment (WFE) in order to achieve the desired production scale. Given the increasingly complex processes involved, coupled with Singapore’s increasingly favourable geopolitical position and government incentives, the country’s semiconductor precision engineering market is expected to grow at a four-year CAGR of 13.4% from 2024-28. |

• Aerospace engineering to drive long-term growth. According to the International Air Transport Association, airline capacity has continued to face shortages due to production constraints and uncertainties around trade tariffs.

As a result, airlines are increasingly reliant on their existing fleets, and this has bolstered demand for maintenance, repairs and overhaul (MRO) services.

At the same time, the key MRO service providers are also facing capacity constraints due to labour shortages, creating opportunities for new entrants such as Metasurface.

We expect the contribution from the aerospace business as a percentage of total revenue to rise from 8.0% in 2024 to 19.8% in 2027.

Stock Impact

• Earnings growth from 2025. Adjusted net profit is expected to grow 25.1%/25.6%/21.8% yoy to S$7.3m/9.1m/11.1m in 2025-27 respectively.

This will primarily be driven by:

| a) a recovery in the precision machining business, b) sustained expansion in the high-margin precision welding business, c) normalising tax rates given the lack of one-off disposal gains, and d) improved operating scale. |

Our adjusted net profit assumptions represent net margins of 15.7%/16.7%/17.4% in 2025-27 respectively.

| Valuation/Recommendation • Initiate coverage with BUY and a target price of HK$2.90 pegged to 7.9x 2026F PE, which is based on a discount to peers’ average. Metasurface’s closest comparables include UMS Holdings (UMS), Grand Venture Technology (Grand Venture) and Frencken Group (Frencken) which are now trading at an average valuation of 15.7x 2026F PE. Given that the combined size of UMS, Grand Venture and Frecken’s businesses is significantly larger than Metasurface’s, and considering Metasurface’s listing on the lower liquidity GEM board, we are applying a 50% discount to our PE multiple. • This is also largely in line with our DCF-derived valuation, based on an equity market premium of 11.2%, a 64/36 equity/debt split and WACC of 19.0. Note that our WACC is elevated to factor in extra risk premium for Metasurface’s smaller market cap and low liquidity. |

→ The UOB KH report dated 8 Sept is here. → The UOB KH report dated 8 Sept is here.(The full version dated 4 Sept is here) → See also: Two Bargain Stocks in UOB KH’s Alpha Portfolio Have 3X ex-cash PE, Lots of Cash, and Growth Catalysts |

vacuum chamber parts to a large semiconductor OEM. That is likely a

reference to parts for Applied Material's Producer platform. As

explained in the press release, Applied Materials has already signalled

that they expect to ramp up production in the coming years. We also

expect memory producers to order more Producer tools going forward.

The PR is here: https://api.aconnect.com.hk/Attachment/134674

We cover the company over at our newsletter:

https://collyer.substack.com/