Yangzijiang's FY2013 gross margin widened, but its net margin dipped due to the expiry of the preferential tax status of its main yard, New Yangzi. This tax status is to be renewed this May. Company photo

Yangzijiang's FY2013 gross margin widened, but its net margin dipped due to the expiry of the preferential tax status of its main yard, New Yangzi. This tax status is to be renewed this May. Company photoEVEN THOUGH China is the world's largest builder of sea transportation vessels with a 40% market share, only about 4% of PRC yards secured new contracts last year and about half are expected to go bust this year, according to industry estimates.

'The margin generated by our maiden jackup oilrig will be less than for our containerships. There is a tuition fee that we are willing to pay for being a new kid on the block,' said executive chairman Ren Yuanlin. Company photo

'The margin generated by our maiden jackup oilrig will be less than for our containerships. There is a tuition fee that we are willing to pay for being a new kid on the block,' said executive chairman Ren Yuanlin. Company photoHe believes offshore engineering is an area China must venture into in spite of the difficulties of breaking into this market. In spite of the tough environment, Yangzijiang Shipbuilding managed to achieve total revenue of Rmb 14.3 billion in FY2013, down a mere 3% year-on-year.

Revenue from the shipbuilding related segment declined 4.9% to Rmb 12.8 billion (89.5% of topline) as it delivered 34 vessels compared to 51 vessels in FY2012.

The impact of the lower shipbuilding revenue was offset by a 14.9% rise in income from financial investments to Rmb 1.5 billion (10.5% of topline).

FY2013 gross margin was up 2.3 percentage points at 33.2%, thanks to its successful foray into the trading of steel and scrap metal, which began to contribute significantly in 4Q2013.

It also lowered financing costs by 44% through its successful negotiation for lower borrowing costs.

However, its net margin dipped 2.6 percentage points to 21.6% due to an increase in the corporate tax rate paid by its main yard, New Yangzi.

From 15%, the subsidiary's tax rate jumped to 25% in FY2013 upon the expiry of its preferential corporate tax status for high tech companies.

The company is renewing its preferential corporate tax status in May and expects to adjust its tax rate back to 15%.

Net profit attributable to shareholders was Rmb 3.1 billion, down 14% year-on-year.

Shipbuilding to recover next year

"This year will be the worst in the current shipbuilding downcycle," cautioned Yangzijiang executive chairman Ren Yuanlin at the company's FY2013 results briefing yesterday (Feb 27).

The downcycle began in 2010 after the shipbuilding boom of 2008 to 2009 resulted in a vessel supply glut.

As it takes about 2 years to construct a vessel, it follows that the excess capacity of under-utilized yards back in 2011 and 2012 will become stark this year.

'We want to build the semi-submersible oilrig that is suitable for median water depth because few yards offer this design, which is cheaper compared to a deepwater vessel,' said CFO Liu Hua. NextInsight file photo

'We want to build the semi-submersible oilrig that is suitable for median water depth because few yards offer this design, which is cheaper compared to a deepwater vessel,' said CFO Liu Hua. NextInsight file photo'The mid-water vessel also has the advantage of being upgradable into a deep water vessel because of similarities in the two types of vessels.'

The good news is, he expects Yangzijiang's shipbuilding output (volume) to grow as much as 80% year-on-year in 2015.

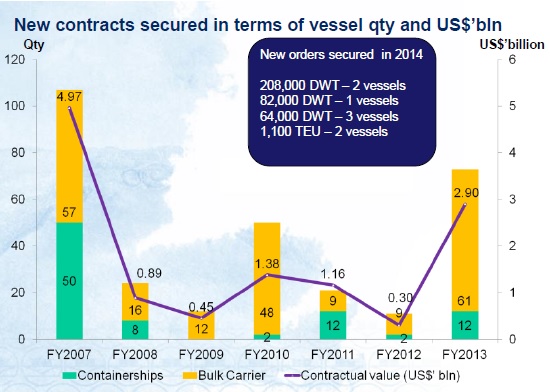

The Group's outstanding order book has increased to US$4.6 billion for 111 vessels (containerships and bulk carriers) as at 27 February, compared to US$3.4 billion a year ago.

Its customers also have outstanding options to exercise rights to build another 11 such vessels at total contract value of US$830 million.

Foray into offshore engineering

Yangzijiang secured its maiden jack-up rig contract at the end of 2012 and construction on this project is progressing according to schedule.

It recently entered into a contract to build 2 semi-submersible rigs for US$825 million, including options for 2 additional similar units.

The contract will only be effective when the Group receives the deposit for the rigs.

"We identified an oilrig designed for median depth seabed as the product we want to offer. It is similar to deep water vessels, with higher steel usage and simpler design," said Mr Ren.

"We do not intend to compete against Singapore rig builders in the shallow water space and we do not intend to compete against the South Koreans in the deep water space.

"From a steel usage viewpoint, China has a competitive advantage in building oilrigs of such a design."

FY2014 will be the most difficult year in this shipbuilding downcycle with a dearth of revenue from vessel deliveries because very few newbuilding orders were placed in 2011 and 2012. The year-on-year surge in order book in 2013 will translate into a surge in 2015 earnings.

FY2014 will be the most difficult year in this shipbuilding downcycle with a dearth of revenue from vessel deliveries because very few newbuilding orders were placed in 2011 and 2012. The year-on-year surge in order book in 2013 will translate into a surge in 2015 earnings.Foray into property development

The Group is going into property development for supplementary revenue that will buffer an earnings contraction during shipbuilding down cycles.

It forayed into property development in 2012 through a joint venture with the Huaxi Group.

It is redeveloping the former yard space at its headquarters in Jiangyin into a commercial and residential district.

On 27 February, it announced its acquisition of a small property developer (Jiangsu Hengyuan Real Estate Development) at book value of Rmb 300 million.

"Acquiring a property company will give us the manpower expertise to run our property development projects independently," said Mr Ren.

"Property development has synergies with the Group.

"Many of our financial investments customers put up real estate as collateral, which will be foreclosed and redesignated as our property development landbank in the event of a credit default. In such foreclosures, our landbank cost will be relatively low as collateral is valued at a fraction of the borrower's land acquisition price.

"The municipal government controls land allocation rights. As one of its top contributors of tax revenue, Yangzijiang will be favored when tendering for land redevelopment projects."

Yangzijiang has 6 yards strategically located along the Yangtze River with annual capacity to build 7.5 million metric tons (MT) of new vessels, fabricate up to 120,000 MT of steel and demolish up to 300,000 MT of vessels.

Yangzijiang has 6 yards strategically located along the Yangtze River with annual capacity to build 7.5 million metric tons (MT) of new vessels, fabricate up to 120,000 MT of steel and demolish up to 300,000 MT of vessels.Recent stories:

YANGZIJIANG 'Outperform', DAIRY FARM 'Entry Opportunity'