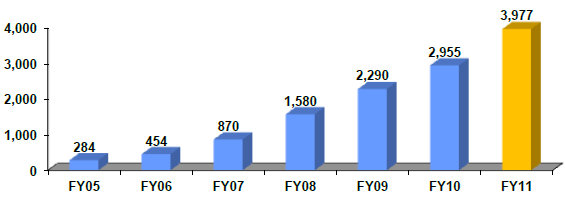

YANGZIJIANG SHIPBUILDING'S FY11 net income grew 35% yoy to a record RMB3,977m, much higher than the consensus of RMB3,688m.

Subsqeuently, analyst ratings had ranged from 'buy' to 'hold' to 'sell'.

The shipbuilder’s revenue increased 16% to RMB15.7 billion as the Group delivered 62 vessels in FY2011 against 50 vessels in FY2010.

Gross gearing surged from 12% in FY10 to 62% in FY11 as working capital requirements rose, due largely to contracts with poorer payment terms.

Yangzijiang took a RMB554mn provision on its Held-To-Maturity investments which was offset by forex gains on forward contracts and tax subsidies.

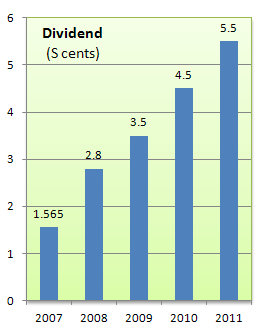

The group announced a final dividend of 5.5 cents a share, up from 4.5 cents in 2001, representing a dividend yield of 4% based on a recent stock price of $1.355.

Yangzijiang has been raising its dividends each year since its listing in April 2007, and its chairman Ren Yuanlin said: “This is a trend we hope to maintain going forward.”

Deutsche Bank analyst Kevin Chong said that, in light of the stock's recent strong performance, current valuations are fair. Hence, he has downgraded the stock to ‘Hold’.

He added that downside may be limited as it is trading well below its historical P/B average of 3.1x.

He lowered his target price to S$1.30.

OCBC Investment Research noted that management is proactively seeking ways to mitigate the effects of a challenging shipbuilding market.

This includes steps to secure new orders: 1) development of new vessel types with lower fuel consumption and higher carrying capacity; 2) development of new business segments.

If initiatives are executed well, “we believe YZJ will emerge as a stronger and more integrated marine group after an industry consolidation,” wrote analysts Low Pei Han and Chia Jiun Yang.

“However, due to the current difficult external environment and inherent risks in some of the group’s initiatives, we lower our peg to 9x FY12F core earnings, resulting in a lower fair value estimate of S$1.51 (prev. S$1.60). Maintain BUY.”

DMG & Partners has a sell on the stock.

“In our view, negative industry dynamics such as oversupply of vessels and excess shipbuilding capacity in China will hurt sector profitability as yards continue to scramble for shipbuilding jobs to fill their capacity,” said analyst Jason Saw.

His target price based on sum-of-the-parts valuation is $1.04.

Maybank Kim Eng analyst Eric Ong also has a sell call: "Considering the difficult and challenging shipping outlook going forward, we downgrade the stock to sell with a SOTP-based target price of $1.15."

CIMB's Lim Siew Khee has an 'underperform' rating and a target price of $1.43.

However, Yangzijiang chairman Ren Yuanlin told Business Times last week that 2012 “should be no worse than 2011”.

As at 31 December 2011, the Group’s order book stood at 100 vessels worth US$4.7 billion. In addition, since the start of 2012, it had secured 7 new contracts with an aggregate value of US$206.2 million.

Yangzijiang's financial statements for FY2011 can be accessed at the SGX website.

Recent story: YANGZIJIANG is a potential 3-bagger