RIDING ON THE semiconductor industry boom, Serial System reported $3.6 million in net profit for 2Q ended June this year.

This is an improvement from the $2.9 m achieved in 1Q of this year. On a year-on-year basis, the $6.5 million 1H net profit this year was a 448% surge.

For 1H this year, Serial yesterday declared a 0.28 cent a share dividend, which is more than double the 0.13 cent given out for the same period last year.

The final dividend may be twice as much as the interim dividend, said Derek Goh, the chairman and CEO, at an analysts’ briefing yesterday.

Some highlights of the 1H results:

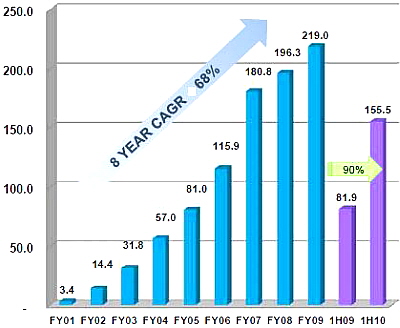

* Revenue came up to $371.0 million, about 59% of which came from Greater China, a region which has proven to be a key success factor for Serial's growth.

If annualized, the revenue for the full year would come up to $742 million, or a growth of 33%.

* Earnings per share was 0.89 cents which, if annualized, will give 1.78 cents, translating into a PE of 7.6X for the current year.

Derek Goh said yesterday that typically the annual dividend is 40-50% of the net earnings.

Assuming 1.78 cents a share in earnings, the total dividend for the year could be 0.89 cents a share, or a yield of 6.6% based on the recent stock price of 13.5 cents.

Asked about the sustainability of Serial System's growth momentum, Mr Goh said that Serial’s expansion of product lines from local to regional bases last year would ‘start to show significant revenue in 2010 and beyond.’

Examples of such product lines are those from Tyco Electronics, Avago and On Semiconductor.

In addition, new product lines from the likes of Osram, AMS and Walsin Group, will add to revenue in 2010 and beyond.

Mr Goh also pointed out that Serial has a track record of achieving a rate of revenue growth that exceeds the industry’s.

Anticipating investor concerns regarding the rising net gearing of Serial (from 27% at end-FY09 to 59% six months later), Mr Goh said that bank borrowings have gone up to support the revenue growth.

.

The Power point presentation is available on the SGX website.

Recent story: SERIAL SYSTEM: Good turnout to hear upbeat business presentation