| Jardine Matheson Holdings has offered to make a cash acquisition of shares held by minority shareholders of Mandarin Oriental International, which is listed in Singapore, London and Bermuda. This move, announced yesterday (17 Oct 2025), concurrently follows a major strategic divestment by Mandarin Oriental: the US$925 million sale of a substantial portion of the new One Causeway Bay (OCB) property in Hong Kong. Two recent NextInsight articles had raised the possibility of both the privatisation of Mandarin Oriental and the sale of OCB: To quote the July article: "Jardine's huge 88% stake screams potential buyout, while Mandarin Oriental's asset-light strategy drives growth and the One Causeway Bay gem could be divested to unlock tremendous value." |

The Buyout and Premium Offer

Jardine Matheson, through its wholly-owned subsidiary Bidco, is seeking to acquire the 11.96 per cent of Mandarin Oriental’s shares that it does not already own.

Independent Mandarin Oriental shareholders are entitled to receive a total of US$3.35 in cash for each share. The stock last closed at US$2.40.

This offer comprises two components: the Scheme Value of US$2.75 in cash, and a special dividend of US$0.60 per share, known as the OCB Dividend. (OCB stands for One Causeway Bay).

The offer represent a substantial premium for shareholders.

For example, the total value is approximately a 52.3 per cent premium to the closing price of US$2.20 on the Unaffected Day (29 September 2025).

Jardine Matheson has stated that the financial terms of the acquisition are final and intends to pursue delisting even if the acquisition does not proceed.

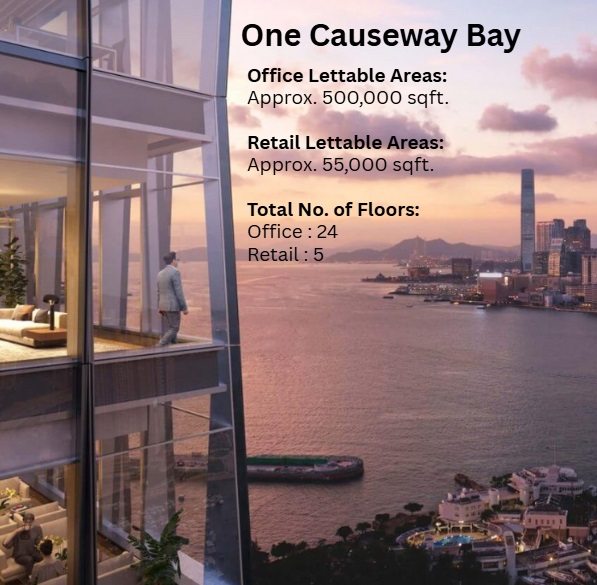

One Causeway Bay Sale Provides the Catalyst

The timing of the buyout is linked to the concurrent sale of the OCB asset.

Mandarin Oriental had entered into an agreement with Alibaba Group and Ant Group.

The deal involves the strata title sale of the top thirteen floors of One Causeway Bay (Levels 21–35) as their Hong Kong headquarters, along with the building’s rooftop signage and 50 parking spaces, for US$925 million.

This OCB Sale is expected to complete by 31 December 2025.

The OCB Dividend (US$0.60 per share) comes from the US$758 million remaining sale proceeds after debt repayment, construction costs, and a fixed sum for enhancements.

|

Read about another branded hospitality play: UOB KH Checks out This Stock (+80% in 2H2025) As Property Profits Overtake Hotel Earnings

Read about another branded hospitality play: UOB KH Checks out This Stock (+80% in 2H2025) As Property Profits Overtake Hotel Earnings