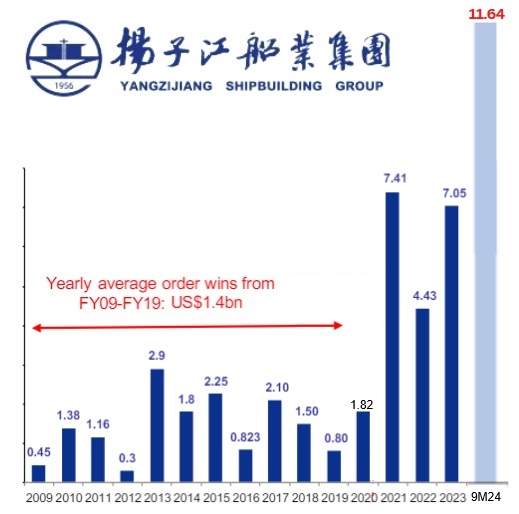

• The 3Q2024 business update of Yangzijiang Shipbuilding showed a continued streak of order wins. No surprise, its stock ($2.68) is up 74% year-to-date as the company is forecasted by CGI to achieve S$1.07 billion profit this year (2023: S$750 million). • In 3Q, Yangzijiang achieved a new customer -- Hapag-Lloyd of Germany, one of the largest container shipping companies globally, ranking fifth in terms of container ship capacity. • Hapag-Loyd ordered US$2.4 billion worth of 12 units of container vessels from Singapore-listed Yangzijiang, one of the largest non-state-owned shipbuilders in China.  • Yangzijiang (market cap: S$10.7 billion) currently sits on a record orderbook of US$22.1 billion to be fulfilled over the next 5 years. It is the amazing outcome of a multi-year success in achieving orders. The leap in order wins in the past 4 years is shown below:  Source: CGS, Company Source: CGS, Company• Read more in excerpts from CGS's report below ... |

CGS International analysts: Lim Siew Khee & Meghana Kande

■ YZJSB has achieved strong order wins of US$11.64bn YTD, with c.US$3.14bn secured in Sep–Nov 2024. Order book stood at US$22.14bn.

■ YZJSB also achieved strong delivery of 22 vessels in 3Q24, YTD: 57 vessels. Catalysts: stronger-than-expected margins and orders. ■ Reiterate Add and TP of S$3.20, still based on 11x CY26F P/E. |

|||||

| Hitting new high in order wins |

● In its 3Q24 business update, YZJSB announced that it has secured US$11.64bn of new orders YTD, implying c.US$3.14bn clinched in Sep-Nov 24.

YZJSGD’s order book stood at US$22.1bn (224 vessels) as of 7 Nov 24. Yamic’s share of order book stood at US$3.19bn with high-end gas carriers accounting for 52% by value.

● The YTD order win trend is largely in line with our forecast of US$11.3bn for 2024. We keep our FY25F/FY26F order win forecasts at US$5.2bn/US$5.2bn.

| Hapag Lloyd – a new customer |

● The new orders secured include c.US$2.4bn of 12 units of 16.8k TEU container vessels from its new customer, Hapag Lloyd (HLAG GY, NR, CP: EUR 153.7).

These vessels will be liquefied gas dual-fuel propulsion and ammonia-ready, scheduled for delivery between 2027F to 2029F.

We estimate the contract value at c.US$2.4bn, based on recent newbuild containership prices reported by Clarksons.

● We believe these vessels will be built in the upcoming new yard in Xinqiao Park of the Jingjiang Economic and Technological Development Zone (see note), which is likely to be approved by local government, in our view.

We believe there are still slots for 2028 delivery from existing yards and 2027 delivery for the new yard.

| Expect a strong 2H24F |

● YZJSB delivered 22 vessels in 3Q24, YTD: 57 vessels. This is 90% of its targeted 63 vessel deliveries in 2024.

We believe 2H24F net profit could be stronger hoh on the back of this. Recall that it achieved US$3bn net profit in 1H24.

We keep our US$5.8bn net profit forecast for FY24F for now. We will revisit our modelling assumptions following the analyst briefing on 8 Nov 2024 at 9am.

|

Full CGS report here.

See also: YANGZIJIANG: After a remarkable 1H2024, this S-chip is on track to make S$1 billion net profit this year