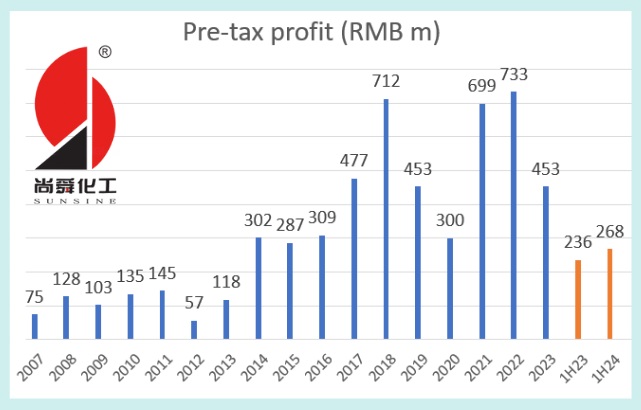

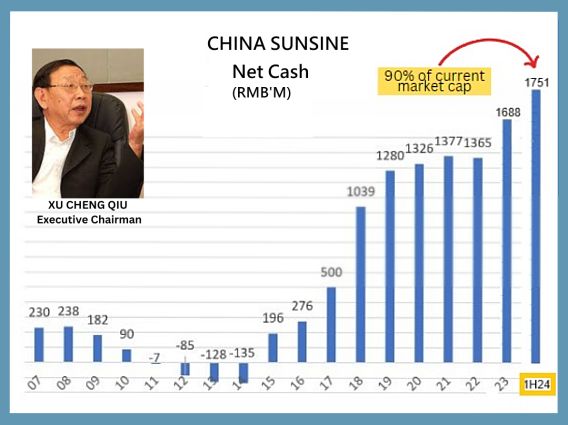

• The large cashpile perhaps was hard to ignore. Or maybe it's the recent news of Chinese economic stimulus. Whichever, China Sunsine received kudos from UOB Kay Hian in a report today, which raised its target price from 46 cents to 58 cents. • It has been a most under-appreciated fact that China Sunsine, despite an ambition to continually expand production capacity, had a growing cashpile that often was nearly equal to its market cap. Check out this chart (and story) we put out in Aug 2024 when the stock was 37 cents:  • China Sunsine, whose stock has recently risen to 48 cents, operates in a very competitive industry that has weeded out a number of players, leaving behind just a few sizeable Chinese peers. As the world's largest producer of rubber chemicals used in tyre manufacturing, China Sunsine has seen its profitability cruise some years, lose altitude in others, or just soar on tailwinds (see chart). |

Excerpts from UOB Kay Hian report

Analysts: Heidi Mo & John Cheong

China Sunsine Chemical (CSSC SP)

As the Chinese economy recovers with the recent stimulus rollout and higher oil prices brought about by the Middle East conflict, Sunsine’s demand and ASPs may benefit. |

WHAT’S NEW

• Potential improvement in demand and ASPs from stronger Chinese economy and oil prices. China’s latest stimulus measures have improved investor sentiment and may boost consumer confidence.

|

China Sunsine |

|

|

Share price: |

Target: |

In addition, oil prices have risen due to the Middle East conflict.

In turn, China Sunsine Chemical’s (Sunsine) demand could see an uptick in the coming months on the back of stronger demand for vehicles as well as better ASPs as Sunsine’s product is a derivative of petroleum products.

During Jul-Sep 24, ASPs have been flattish on the back of stable raw material prices. Meanwhile, China’s GDP grew 5% in 1H24.

• Good dividend yield of around 5% backed by strong balance sheet. Sunsine provides an attractive yield of around 5%, supported by its robust cash balance of Rmb1,751m (+4% hoh) as of 1H24.

This translates to Rmb1.82/share (S$0.34/share) or around 70% of its market cap.

This provides ample room for Sunsine to potentially raise its dividend and continue to perform share buybacks. Sunsine has bought back 3.8m shares for 2024 since the start of its 2024 share buyback plan on 26 Apr 24.

• Expect steady volume growth on the back of strong demand. Sunsine achieved stronger rubber chemical sales volume (+6% yoy) in 1H24. This was driven by higher international sales volume (+20% yoy) from increased capacity utilisation rates for tyre manufacturers based in Southeast Asia, partially offset by lower domestic demand (-2% yoy).

As more Chinese tyre manufacturers look to Southeast Asia to beef up production, we expect international sales volume to grow further.

Moreover, automakers reported a 6% yoy increase in auto sales in China, while new energy vehicles saw a 32% yoy surge in 1H24. We therefore expect sales volume growth to remain steady for 2024.

• 1H24 results within expectations. Sunsine reported 1H24 earnings of Rmb189m (-3% yoy), which accounted for 49% of our full-year forecast and is largely in line with our expectation.

"(Cash balance) provides ample room for Sunsine to potentially raise its dividend and continue to perform share buybacks. Sunsine has bought back 3.8m shares for 2024 since the start of its 2024 share buyback plan on 26 Apr 24." - UOB KH |

Revenue was flattish yoy at Rmb1,749m, as the higher sales volume (+6% yoy) was offset by a 4% yoy decrease in ASPs.

Sunsine continues to adopt a flexible pricing strategy to maintain price competitiveness. Gross margin improved more than expected at 24.8% (+1ppt yoy), but net margin fell 0.5ppt.

STOCK IMPACT

• Continuing to dominate the accelerator market. Management shared that they have successfully maintained their position as the world’s largest accelerator producer, with its market share growing from 22% in 2022 to 23% in 2023. In China, they have also grown their market-leading share from 33% to 35% in 2023.

With the largest accelerator capacity globally at 117,000 tonnes, Sunsine is poised to grow its strong customer base of over 1,000, which includes more than 75% of the global top 75 tyre makers including Bridgestone, Goodyear and Michelin.

• Expansion projects underway for 2025 growth. Phase 1 of a high-quality intermediate material project of 20,000 tonnes/year capacity is expected to commence production in 4Q24, while Phase 2 of an insoluble sulphur project of 30,000 tonnes/year capacity is expected to be completed by end-24.

These projects will increase capacity and allow Sunsine to meet customers’ requirements, pointing toward higher sales volume in 2025.

EARNINGS REVISION/RISK

• We have raised our 2024/25 gross margin assumptions from 23%/24% to 24%/25% respectively while adding 2026 forecasts, as raw material costs continue to moderate.

However, we have doubled our tax rate forecasts as Sunsine’s main subsidiary, Shandong Sunsine, no longer enjoys the 15% concessionary tax rate.

We note that Sunsine is still conducting an internal assessment on whether to re-apply for the High-Tech Enterprise status of Shandong Sunsine, which previously expired in Dec 23.

• As a result, we have lowered our 2024/25 earnings estimates by 3%/5% to Rmb374m/Rmb402m respectively (from Rmb388m/Rmb426m previously).

VALUATION/RECOMMENDATION Heidi Mo, analyst• Maintain BUY with a 26% higher target price of S$0.58 (S$0.46 previously), after raising our valuation multiple to +1SD above mean PE of 7.5x 2025F earnings, up from its mean PE of 6x 2024F earnings previously to capture the potential demand and ASPs recovery in 2025. Heidi Mo, analyst• Maintain BUY with a 26% higher target price of S$0.58 (S$0.46 previously), after raising our valuation multiple to +1SD above mean PE of 7.5x 2025F earnings, up from its mean PE of 6x 2024F earnings previously to capture the potential demand and ASPs recovery in 2025.The stock trades at an attractive valuation of 2x ex-cash 2024F PE. SHARE PRICE CATALYST • New manufacturing capacities commencing production. • Higher ASPs for rubber chemicals. • Higher-than-expected utilisation rates. |

Full report here.