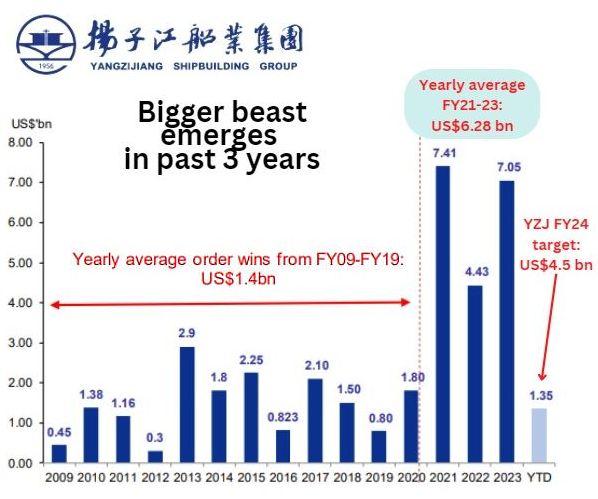

| • Yangzijiang Shipbuilding is closely tracked by analysts, and the Chinese shipbuilder's latest set of results has turned out as good as they expected. • It was a record RMB 4.1 billion profit (+57% y-o-y) and a record dividend (6.5 SG cents).  • CGS-CIMB expects an even higher dividend of 7 cents for FY2024 -- and for good reason. Yangzijiang in FY24 will ride on its record orderbook and, better still, an expanded gross margin. • The orderbook, whose progression is shown below, is not only massive but reflects a shipbuilder that has made a quantum leap in its order-clinching ability over the past 3 years. It's a bigger beast.  Source: CGS-CIMB, Company, NextInsight Source: CGS-CIMB, Company, NextInsight• Read more in excerpts from CGS-CIMB's latest report below ... |

CGS-CIMB analyst: Lim Siew Khee

■ 2H23 core GM of 20% is a testament of execution of high value contracts against weaker RMB and steel costs. We expect GM of 24% in FY24F.

■ DPS of S$0.065 was declared or 33% payout. This is likely to be sustained in FY24F on the back of earnings growth. We expect FY24F DPS of S$0.07. ■ Maintain Add with TP at S$1.96, still on 2x FY24F P/BV or 40% above peers on the back of its better margin profile and order executing track record. |

|||||

| Higher core shipbuilding GM, trend to get better in FY24F |

2H23 net profit of S$2.375bn beat Bloomberg consensus by 14% and ours by 6%.

FY23 net profit at Rmb4.1bn was 4% above our full-year forecast due to stronger GM and 8% above Bloomberg consensus’.

Reported GM for shipbuilding of 26% included profit from rig sale of c.US$45m.

Ex-rig sale, core shipbuilding GM of c.20% in FY23 is slightly higher than our 19%.

YZJSB said that the lower value contracts secured in 2019-20 have all been delivered. The yard started to deliver better priced contracts in 2H23.

In addition, weaker renminbi and steel costs also helped to lift gross margin. YZJSB expects better GM in FY24F as steel price is likely to remain stable at Rmb4,300-4,400/tonne (ex-VAT) in 2024.

We have penned in shipbuilding margin of 24% in FY24F

| More enquiries for oil tankers and gas carriers; 2027 slots available |

Management sees active enquiries in oil tankers as well as gas carriers such as Very Large Ammonia Carriers (VLAC) or Very Large Ethanol Carriers (VLEC).

On average, these contracts also fetch higher pricing (c.US$150m/ea for 100Kcbm m).

However, they note that containership enquires/orders are likely to peak in 2024 and current enquiries are from large shipowners looking to replace fleet with green vessels (less speculators).

YTD order wins reached US$1.35bn, comprised of 12 vessels, including 6 units of 13k TEUs green container vessels (dual fuel methanol) for Japan, ONE Shipping.

Orderbook stood at US$14.5bn with delivery stretching into 2028.

At present, the yard is full and any new contract wins will likely be delivered in 2027 according to management.

Given the strong momentum achieved YTD, YZJSB raised its order guidance to US$4.5bn in FY24F (from US$3bn).

|

Full report here.