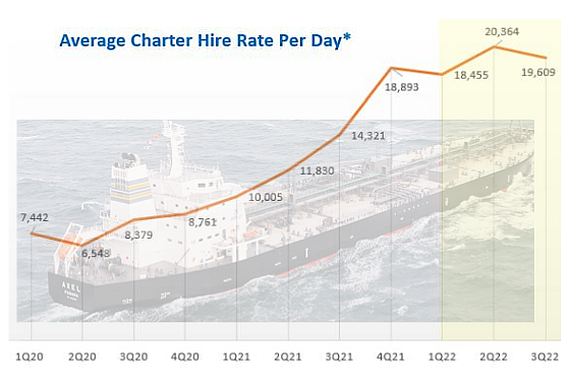

| The average daily charter hire rate that Uni-Asia Group achieved in 3Q2022 held steady from 2Q2022, as the chart below shows. That has contributed to the Singapore-listed shipping/property group's strong 9M2022 operating cash flows of US$28.0 million (9M2021: US$19.1 million). Other contributors were the sale of properties under development and fee income including ship finance arrangement fees and property-related fee income in Japan. For 1H2022, net profit came in at US$16.5 million, a 134% increase from 1H2021. Uni-Asia did not give a profit figure for 3Q2022. |

* 10 wholly-owned handysize dry bulkships

* 10 wholly-owned handysize dry bulkships

In a Q&A session with investors last week, Uni-Asia CFO Lim Kai Ching explained the charter situation:

Q: Can you shed more light on why the average charter hire rate has stayed stable despite a sharp 50% fall in the Baltic handysize index since March 2022?

CFO Lim Kai ChingA: We time charter our vessels out and we provide management services and so forth but the fuel for running the ships is not our responsibility. During this period, the charter rates are based on the time charter rates agreed and signed in the contract between the charterer and ourselves.

CFO Lim Kai ChingA: We time charter our vessels out and we provide management services and so forth but the fuel for running the ships is not our responsibility. During this period, the charter rates are based on the time charter rates agreed and signed in the contract between the charterer and ourselves.

Our charterers are the main shipping lines for dry bulk, and they will take orders from the direct customers to ship their goods. When we look at the Baltic handysize index, it is based on the actual supply and demand and it's reflective of the market at a particular point in time, and can go up and down over time. But our charter rates are already fixed, so the index has no impact on our charter rates. We were quite lucky that in 2021 and 2022 all our vessels were open to refixing of charter rates.

|

Stock price |

81 c |

|

52-wk range |

75 c – $1.41 |

|

PE (ttm) |

1.7 |

|

Market cap |

$64 m |

|

Shares outstanding |

78.6 m |

|

Dividend |

11.7% |

|

1-yr return |

-39% |

|

P/B |

0.3 |

|

Source: Yahoo! |

|

Notwithstanding this, all our charters are less than one year, so there are some vessels that are due for fixing within the next one or two months and some in the next year.

We will definitely be affected if the rates do not improve for early part of next year or later part of this year or going forward for the next one and a half years. Some charterers have a pessimistic view of the demand from their customers going forward and therefore are not as aggressive in bidding for time charter rates for vessels.

Q: As you have mentioned, there is a upcoming shortage of supply of handysize vessels. Why are even your competitors not ordering new vessels?

A: One of the greatest concerns is the technology as the whole shipping market tries to move towards zero emission by 2050. There's a lot of uncertainty as to what kind of technology will be available, so most shipping companies are taking a wait-and-see approach.

Some shipping companies would rather buy secondhand ships rather than put in capital to build new vessels only to later find that they have to spend additional money for dry docking to upgrade the technology. This is the general sentiment now, so if you speak to any shipping person they will they will tell you the same thing.

|

Factors favourable to dry bulk market |

|

• Dry bulk orderbook at 30-year low of 7% of fleet capacity. |

|

Uncertain factors facing dry bulk market: |

|

• China’s economy recovery (zero Covid policy). |

|

Source: Uni-Asia |

Paul Chew"Our FY23e PATMI is lowered by 13% to US$19.2mn. Unless freight rates recover in 1Q23, there is a risk the next renewal cycle will be a major drag to revenue. Paul Chew"Our FY23e PATMI is lowered by 13% to US$19.2mn. Unless freight rates recover in 1Q23, there is a risk the next renewal cycle will be a major drag to revenue."We maintain our BUY recommendation and target price of S$1.26. The target price is pegged to 3x P/E FY22e, in line with industry peers. "The soft economic conditions in China have led to softer demand for bulk commodities. Nevertheless, supporting longer-term freight rates will be the 30-year low in new dry bulk vessels of only 7% of fleet." |

See Uni-Asia's presentation deck here.