Uni-Asia Group (UAG SP): Hot property

- BUY Entry – 1.30 Target – 1.66 Stop Loss – 1.12

- UAG is an alternative investment company that owns and manages bulk carriers, invests in Hong Kong commercial offices and develops residential properties in Japan. The group derives around 65% of its revenues from charter income generated by its fleet of bulk carriers. The remainder of its revenue is from the property projects in HK and Japan.

- Smaller vessels are in hot demand. The Baltic Handysize Index (BHI) dropped by 50% from October 2021 to January 2022 but rebounded by more than 40% since the start of February 2022.

Even then, BHI at where it stands now is still at levels that are more than double the average rates seen over the past 10 years as demand for smaller vessels have continued to find support amid an already stretched global supply chain.

Eight of UAG’s wholly-owned dry bulks will renew in 2022, and another two in 1Q2023. Unlike previous rounds of bull markets in the handysize dry bulk shipping market, this upcycle seems more robust given the better dynamics in the market.

- Dry bulk carriers supply-demand dynamics are favourable. In the last shipping super cycle (2006-2008), new handysize orders made up as much as 50% of the total fleet, driven by significant speculative demand and easy financing. But recent orderbook for handysize bulk carriers has fallen to a multi-decade low of 4.6% of current fleet size by deadweight tonnage (dwt), thus providing a very good supply-demand dynamic for the sector.

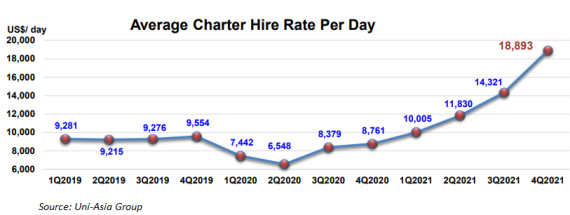

- Higher average charter rates. UAG’s average charter rate increased from US$14,321 in 3Q2021 to US$18,893 in 4Q2021. This marks the sixth consecutive quarter of QoQ increase. The group will be renewing the charters for its 10-wholly owned vessels in 2022 and 1Q2023.