| As the electric vehicle (EV) era dawns, opportunities and disruptions will emerge in multiple industries. EVs have much more electronics content, deriving from sensors, advanced driver-assistance computing systems, power management, and camera modules and more. This demand has been identified by ASM Pacific Technology (ASMPT) as a key, sustained growth driver for its future. "We are at a profound inflection point in automotive technologies," said Robin Ng, CEO of ASMPT, at an earnings call following the release of its FY20 results. Headquartered in Singapore and listed on the Hong Kong Stock Exchange, ASMPT is a leading global supplier of hardware and software solutions for the manufacture of semiconductors and electronics. Its dominance comes from its R&D focus, a snapshot of which is as follows:  |

Smartphones and PCs presently are the largest product drivers for semiconductors.

Automotive is becoming an increasingly important market for semiconductors, with average semiconductor content per vehicle set to rise rapidly.

"We stand to benefit with our range of solutions ranging from packaging and assembly to surface mount technology in the automotive application space," said Mr Ng.

In addition, ASMPT has the ability to "progressively incorporate data driven, closed loop machine learning components that will further advance the path for automotive electrification and automation."

|

|

Stock price |

HK$99.35 |

|

52-week range |

HK$68.70 – 133.80 |

|

Market cap |

HK$40.8 b |

|

PE (ttm) |

25 |

|

Dividend yield |

2.7% |

|

1-year return |

37% |

|

Shares outstanding |

410.8 m |

|

Source: AAStocks.com |

|

As the vaccine rollout gains momentum, economies will gradually return to normalcy, which would have further positive impact on the semiconductor industry which already has gained from trends such as working from home and e-commerce.

Industry research forecasts that 2021 will see broad-based semiconductor growth of 8%.

Investments in personal mobility and computing devices, cloud data centres and communications infrastructure are expected to be sustained.

Further, automotive and industrial markets are forecasted to rebound in 2021 from the trough experienced in 2020.

|

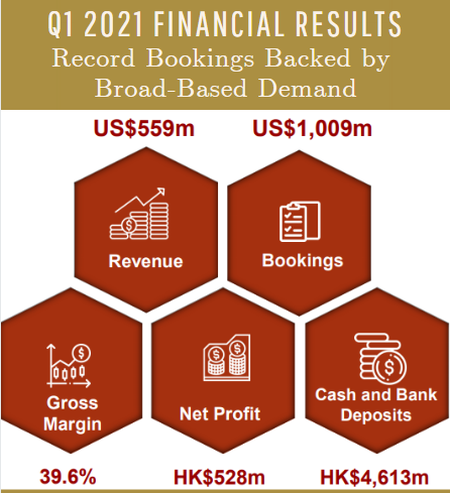

1Q2021: It's a record quarter! |

Amidst stronger signs of improving macro-economic conditions, and a slow and uneven global recovery from the COVID-19 pandemic, the Group was able to achieve a strong financial performance.

● 1Q2021 revenue: HK$4.34 billion (US$559.3 million) from its continuing operations (2020 Q1: HK$2.98 billion, or US$382.6 million).

● Consolidated profit after taxation: HK$528.4 million (2020 Q1: HK$25.5 million).

● Basic earnings per share: HK$1.27 (2020 Q1: HK$0.06).

Revenue performance came from a broad range of factors.

For one, customers increased investment in capacity expansion to achieve semiconductor self-sufficiency. There was also continued recovery for automotive and industrial applications, while longer term growth trends including accelerated digital transformation, automotive electrification, and the global 5G roll-out continued to exert their influence.

“Year 2020 was a tumultuous one, but we managed to close it off quite well. I am very pleased that our performance this quarter continues to achieve new heights. With the world’s appetite for silicon showing no sign of slowing down, our market position, our technologies and the fundamentals driving our business and future prospects continue to look bright,” said Robin.

Of note, the Group recently received a distinguished 2020 Supplier Achievement Award from Intel Corporation for its COVID-19 response, a special recognition for ensuring uninterrupted supply to them through the pandemic period.

A strong surge of customer demand in 1Q2021 drove Group bookings to record levels, to the tune of HK$7.83 billion (US$1.01 billion).

This strong YoY growth of 73.4% and QoQ growth of 86.4% in bookings was dominated by the Semiconductor Solutions Segment, while the SMT Solutions Segment also registered record bookings representing strong QoQ increase in demand.

The Group ended the quarter with a strong backlog amounting to HK$9.38 billion (US$1.21 billion) and book-to-bill ratio of 1.80.

For more info on the 1QFY21 results, see press release here and Powerpoint presentation materials here.