Soo Jin Hou contributed this article

|

For the past couple of years, central banks around the world have declared war against cash.

|

PAX Global (HKEX: 327) has been riding on the war on cash and it trades at unbelievably cheap valuation.

PAX Global (HKEX: 327) has been riding on the war on cash and it trades at unbelievably cheap valuation.

PAX makes point-of-sales (POS) terminals and sells them to merchant acquirers all over the world.

All the known listed customers of PAX trade at mid double-digit price-earning-ratios, but PAX trades at a mere 7.5 PER at a share price of HKD4.0.

|

Bourse |

PER (ttm) |

EV/EBIT |

|

|

PAX |

HKEX |

7.5 |

2.6 |

|

Revenue Group |

Bursa |

55.6 |

41.7 |

|

GHL Systems |

Bursa |

42.3 |

25.1 |

|

StoneCo |

Nasdaq |

65.9 |

34.5 |

|

Pagseguro Digital |

NYSE |

33.2 |

22.5 |

When balance sheet strength is taken into account, the difference in valuation is even more extreme with PAX’s EV/EBIT at just 2.6. This is due to PAX’s cash hoard making up 58% of its market capitalization, or HKD2.5b.

It is inexplicable that the market is highly optimistic on the prospects of PAX’ customers, and yet this optimism does not extend to the enabler of their businesses.

The 2 largest POS players in the world are Ingenico and Verifone.

Verifone was bought out by private equity group Francisco Partners in 2018 for US$3.4b, and Ingenico is about to be acquired by Worldline for US$8.6b.

While the revenues of Ingenico and Verifone are 6x and 3x that of PAX, respectively, PAX trades at only a fraction of their acquisition prices at an enterprise value (EV) of US$238m.

In other words, Ingenico and Verifone are valued at 36x and 14x more expensive than PAX.

|

Bourse |

PER (ttm) |

EV/EBIT |

Revenue (2018) |

|

|

PAX |

HKEX |

7.5 |

2.6 |

USD$569m |

|

Ingenico |

Paris |

38.46 |

32.7 |

USD$3,320m |

|

Verifone * |

NYSE |

Loss making |

Loss making |

USD$1,870b |

* Last available full fiscal year result

The discrepancy in valuation is mind boggling. It is not as if PAX is not doing well.

While it is true that margins have contracted due to stiffer competition from other POS as well as new fintech players, PAX has compensated by winning greater market shares in Latin America, especially in Brazil, and Asia Pacific.

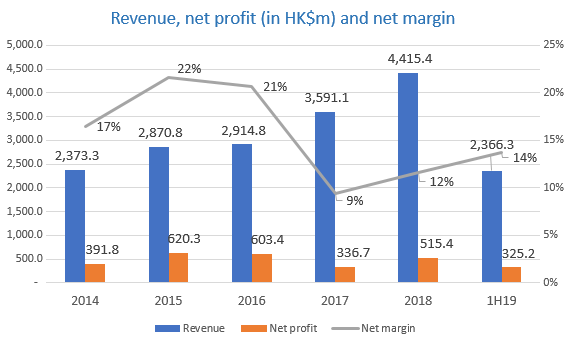

In fact, PAX saw strong growth from 2017 up to 1H19, and has issued recently a positive profit alert that the profit for 2019 will see a growth of at least 20%.

Since 1H19 saw a growth of 28% compared to 1H18, 2H19 will certainly be stronger than 2H18.

But the POS terminal business faces 2 primary threats:

| 1) the growth of online commerce where payments are executed without any physical terminals, and 2) the increasing popularity of fintech innovations such as e-wallets and QR codes where payments are executed via apps. |

While the need for POS terminals may diminish as a result, no physical store can reasonably function without a POS terminal.

Firstly, terminals are needed to process physical Visa or Mastercard payments, which are the 2 most popular credit card payments in the world.

Secondly, POS terminals are needed to issue physical paper receipts that serves as proof of purchase.

To PAX’s credit, they have strived to offer an omni channel payment solution catering to all types of payments including e-wallets like Alipay and WeChat Pay.

|

Revenue outside of China, US |

|

PAX offers considerable protection against the trade war between US and China, as well as the turmoil in China from the novel coronavirus, as most of its revenue is generated outside these 2 countries. PAX is doing especially well in Brazil, the largest economy in Latin America. |

This is done via their proprietary app store called PAXPAY where new functionality can be introduced to their Android-based terminals.

Despite sitting on a large cash hoard, PAX is not particularly generous with dividends.

Payout in 2019 only amounts to 15% of earnings, yielding just 2%.

However, company has started share buybacks recently and from 7/1/20 to 10/2/20, PAX bought back 9.6m shares, which cost about HKD36.5m assuming average purchase price of HKD3.8.

Other pertinent financial metrics are:

|

Market capitalisation |

HKD4.4b |

|

ROE |

13% |

|

ROIC |

31% |

|

Price to book |

98% |

PAX announced in December 2019 its intention to enter the Australian market.

It is an astute move because Australia has a large Chinese diaspora community and it receives many Chinese tourists.

This community is under-served in a payment regime dominated by Visa and Mastercard because their payment methods of choice are typically UnionPay, Alipay or WeChat Pay.

Soo Jin HouIn conclusion, the recently announced acquisition of Ingenico is an immediate affirmation of the unbelievable bargain PAX is at the current price. Soo Jin HouIn conclusion, the recently announced acquisition of Ingenico is an immediate affirmation of the unbelievable bargain PAX is at the current price. Notwithstanding rising competition, the secular trend of demonetisation espoused by central banks and governments around the world should continue to support PAX's growth. At the same time, PAX has plenty of financial firepower for acquisition should they need to as the industry consolidates. |