Lotustpsll, 61, worked 32 years with a global banking group before he retired. Yesterday, he shared his views in the NextInsight forum on Best World and FSL Trust Crowd of potential distributors at Best World event in Changsa in Hunan province. Photo: Company. Best World: Share price corrected again (7 Feb) due to SGX query and a restriction placed by UOB Kay Hian on the stock trading.

Crowd of potential distributors at Best World event in Changsa in Hunan province. Photo: Company. Best World: Share price corrected again (7 Feb) due to SGX query and a restriction placed by UOB Kay Hian on the stock trading.

On past occasions, after a correction, Best World’s share price rebounded and headed higher.

|

Date |

Share price |

|

|

6 Feb |

$1.955 |

|

|

7 Feb |

$1.76 |

- 9.97% |

|

8 Feb |

$1.83 |

+3.98% |

In my view, this setback will soon pass and the catalyst will be the full year results due later this month.

Unless the results are below expectation (this is unlikely), the momentum of the price trend will continue to be positive.

|

|

Target |

2016F net profit |

2016F dividend* |

||

|

DBS Vickers |

$2.36 |

$29.8 m |

4.72 c |

||

|

CLSA |

$2.50 |

$31 m |

4.7 c |

||

|

Maybank Kim Eng |

$2.11 |

$29 m |

3.75 c |

||

|

CIMB |

$2.21 |

$30.3 m |

3.6 c |

||

|

* Includes 2 cent interim dividend paid prior to a bonus share issue. NextInsight compilation |

|||||

I find it strange that some securities houses are placing trading restrictions (Phillip Securities, UOB), whilst others have issued “Buy” ratings. The contrast here is rather startling.

Best World is a home-grown business, established over 25 years ago. Surely a quick check on its website will confirm this fact.

As I have said before, BW is no Blumont or Liongold. Just because its share price has risen strongly over the past 12 months, does this warrant a trading restriction or repeated queries from SGX?

Fundamentally, in my view, its share price is driven by its exciting growth profile; the icing on the cake now is the granting of a direct-selling licence in China. I guess the best defence for the Group is to report a solid FY16 performance.

This should silence its critics and reward the research houses who stood by them.

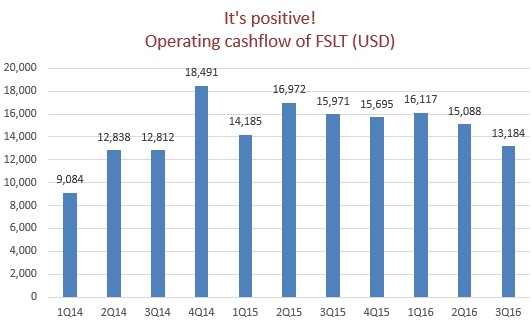

| First Ship Lease Trust: The past 5 months have been disappointing for its shareholders. I reviewed again the investing merits of FSL and I am convinced that this stock is a steal at current price (13 cents) and a classic contrarian play. - Based on reported distribution up to 9 months, yield is now over 20% - Operating Cash Flow remains positive (confirmed in latest announcement) - Asset write-downs (expected in a cyclical shipping business) has no impact on cash flow - New management team in place - New CEO was formerly COO of FSL (an old hand in the industry with over 30 years experience) - Newly appointed CFO is an experienced finance man (his profile is on the company’s website)  NextInsight compilation NextInsight compilation The corporate governance issues were serious and I believe they are now under control with the resignation of the previous CEO. There is a clear lesson to be learnt. The position of CFO was vacant since October 2014. This likely led to certain lapses of “check and balance” functions. Some members of the current Board were appointed prior to October 2014 and they should take some blame for this matter. The following should be the order of priority now :- - conduct special audit on its financial functions and ensure that the weaknesses are identified and addressed - engage with its shareholders and be candid on the results of the special audit findings - keep shareholders fully informed on the progress of the loan refinancing proposal In short, the Board should earnestly re-build and regain the trust of its shareholders. For the present time, I am keeping my faith with FSL. |

FSLT: Thursday, 23 February

2017, after trading hours.

Since it dropped from 0.18 to 0.13 last 6 months