| The market will soon enter the peak results season. The companies listed below can be expected to report record earnings. While their stock prices have risen in the past couple of months, some of them continue to sport attractive valuations.

|

||||||||||||||||||||||||||||||||

Doreen Tan, co-chairwoman of Best World. Photo: Company 1. Best World International: Earnings in 9M2016 were up 97.4% y-o-y to $22.3 million.

Doreen Tan, co-chairwoman of Best World. Photo: Company 1. Best World International: Earnings in 9M2016 were up 97.4% y-o-y to $22.3 million.

With that figure, it is a given that Best World will beat the previous full-year record earnings (2007: $13.4 million).

The share price has re-rated powerfully (+635% in the past 12 months) on twin boosters: Prospects of excellent 2016 earnings and, more importantly, Best World's new foray into direct-selling in China.

(See: BEST WORLD: To deliver record profit and dividend for FY2016?)

2. Dutech Holdings: Earnings in 9M2016 were up 9.7% y-o-y to RMB105.3 million.

The last record earnings was in full-year 2014 when it achieved RMB 144.8 m.

See investor ThumbtackInvestor's explanation of why he expects 4Q16 to be "a blowout quarter" for Dutech:DUTECH: I predict a blowout 4Q16 on an one-off gain

3. China Aviation Oil: 9M2016 earnings grew 4% y-o-y to RMB155.4 million. UOB Kay Hian forecasts US$80.5 million for the full-year, which is a record. (See: CHINA AVIATION OIL: News of record profit of US$80.6 m in Feb 2017?)

The last record earnings was in 2013 when it achieved US$70.2 m.

Qian Jianrong, executive chairman, CWG International. NextInsight file photo 4. CWG Int'l: The Chinese property developer was listed via a reverse takeover in 2014. That year and in the following year, it reported relatively small gains of RMB10 m and RMB37 m, respectively. Qian Jianrong, executive chairman, CWG International. NextInsight file photo 4. CWG Int'l: The Chinese property developer was listed via a reverse takeover in 2014. That year and in the following year, it reported relatively small gains of RMB10 m and RMB37 m, respectively. Red ink (RMB107.5 m) flowed in 9M2016. However, with three projects achieving TOP in 4Q2016, with significant profitability in aggregate, the bottomline will be positive. RHB Research (page 11 of report) has forecasted net profit of RMB158 million. And CWG has guided for a 1-c dividend as the base, translating into a yield of 6%. |

Nordic has consistently earned more profit every year in the past 5 years.5. Nordic Group: 9M2016 earnings grew 24% y-o-y to $8.9 million on the strength of the company's maintenance services for oil majors in Singapore.

Nordic has consistently earned more profit every year in the past 5 years.5. Nordic Group: 9M2016 earnings grew 24% y-o-y to $8.9 million on the strength of the company's maintenance services for oil majors in Singapore.

If Nordic achieves anything like the $3.3 million of 4Q2015, then it would have record 2016 earnings.

The last record earnings was in 2015 when it achieved $10.5 m. (See: NORDIC GROUP: Profit up 23% to S$8.9 m in 9M2016)

6. Sunpower Group: Earnings in 9M2016 were up 97.4% y-o-y to RMB87.5 million.

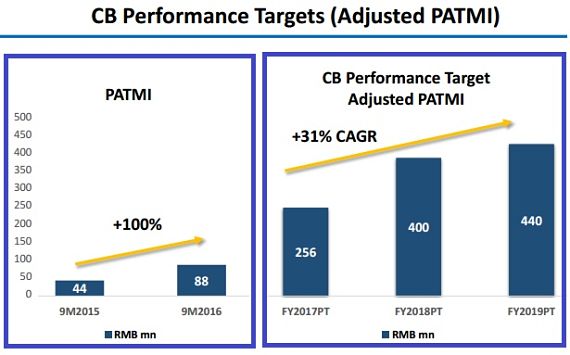

That already exceeds the full-year 2015 profit of RMB81.5 million. The last record earnings was in 2011 when it achieved RMB91 million.  Source: Page 21 of Sunpower's presentation that was uploaded to the SGX website.

Source: Page 21 of Sunpower's presentation that was uploaded to the SGX website.

Sunpower's best days lie ahead: Based on its agreement with a new strategic convertible bond holder, Sunpower has a 2017 profit target that is approximately double 2016 earnings. For 2018, it is about 56% higher than 2017 earnings.

What's the growth driver? It is Sunpower's increasing prowess in utilising its capabilities in a new business segment which helps the country combat air pollution.

As the company says: "We believe there is an enormous market opportunity in years to come and we are among the first movers. Our past experiences in environmental protection services make us unique and competitive."

(See: SUNPOWER: S-chip share price at record high, heading for record profit)