|

|

Investment case: Most resilient

Ezion's liftboats are used mainly for well-servicing, commissioning, maintenance and decommissioning of offshore platforms. Photos: CompanyDemand for Ezion’s liftboats remains strong as customers start to appreciate the versatility, capabilities and efficiency of this asset class. This comes from the need for oil companies to maintain oil production at lower costs.

Ezion's liftboats are used mainly for well-servicing, commissioning, maintenance and decommissioning of offshore platforms. Photos: CompanyDemand for Ezion’s liftboats remains strong as customers start to appreciate the versatility, capabilities and efficiency of this asset class. This comes from the need for oil companies to maintain oil production at lower costs. Importantly, Ezion expects rates for most FY15 contract renewals to hold. Earnings growth should come from the deployment of another 9-10 units in FY15, which should swing FCF to positive territory. Longer term, Ezion may extend its lead in liftboats in Southeast Asia and the Middle East.

Catalysts: Earnings stability & growth

Catalysts could come from contract wins, higher-than-expected renewal rates and earnings growth, especially over the next few quarters when the other players struggle.

Valuation: SGD1.83 TP

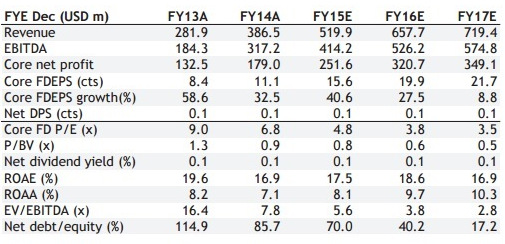

We value Ezion at 9x FY15E fully-diluted EPS, its 5-year mean. We believe mean valuations are justified even in the current sector downturn. This is due to its strong earnings visibility and operating cashflows which are supported by secured contracts. Maintain BUY.

Risks: Delays & cancellations

Key risks are: 1) delays in liftboat deployments due to late yard deliveries; 2) lower-than-expected renewal rates; and 3) contract cancellations.