Excerpts from analyst's report

Daiwa Capital Markets analyst: Jame Osman

Target price: SGD0.73 (from SGD0.79) Target price: SGD0.73 (from SGD0.79) Share price (6 Oct): SGD0.81 | Up/downside: -9.8% Near-term challenges remain » Headwinds persist across both the BC and FI segments » 3Q15 likely to remain weak; we look for clearer recovery signs in 4Q » Reaffirm Underperform (4) rating |

What’s new: Following our recent discussion with Super Group, we believe the near-term challenges facing the company are likely to persist in 3Q15, while we now think some of its recent initiatives could contribute meaningfully to its earnings only from 4Q15 onward.

What’s the impact: According to the company, macroeconomic headwinds, in particular the weakening regional currencies environment, is a common thread impacting operational performance in Super’s core markets in its branded consumer (BC) segment.

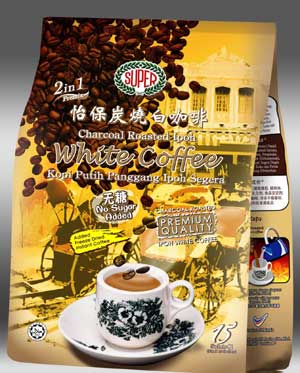

We believe this may have eroded Super’s price competitiveness to an extent, allowing local competitors to gain market share in the instant coffee segment. Further, in Myanmar, its second largest market, severe floods which began in July are also likely to impact its 3Q15 performance. In terms of its recent initiatives, the company said that new product launches, as well as its partnership with Café Cagliari, are only expected to contribute meaningfully in 4Q15.

Meanwhile, we expect Super’s food ingredients (FI) segment to continue to be impacted negatively by weak non-dairy creamer (NDC) sales trends (2Q15: down 18% YoY), although we believe this could be mitigated in part by its product diversification efforts (it started marketing activities for botanical herbal extracts, nutritional oil powder etc. in 2Q15).

"While we continue to like Super’s longer-term business growth strategy (a focus on innovation and product diversification amid its rebranding efforts), the stock is trading at a 2015E PER of 16.7x, which we view as unattractive given its relatively modest earnings-growth profile (net profit CAGR of 1.2% over 2014-17E vs. 27.4% over 2008-13). "While we continue to like Super’s longer-term business growth strategy (a focus on innovation and product diversification amid its rebranding efforts), the stock is trading at a 2015E PER of 16.7x, which we view as unattractive given its relatively modest earnings-growth profile (net profit CAGR of 1.2% over 2014-17E vs. 27.4% over 2008-13). "Hence, despite the 47% decline in the share price over the past 6 months and 32% downward revision to the 2015-16E Bloomberg consensus EPS forecasts over the past year, we reaffirm our Underperform (4) rating on the stock. A turnaround in its BC segment is a key upside risk." -- Jame Osman (photo) |

We are lowering our 2015-17E revenue forecasts by 3%. We now forecast overall 2015E revenue to decline by 1.6% YoY (previously revenue growth of 1.0%). As a result, we cut our 2015-17E EPS forecasts by 5-8%.

What we recommend: We lower our PER-based 12-month target price to SGD0.73 (from SGD0.79), based on a target PER of 15x applied to our 2015E EPS, which is at around a 20% discount to its past 6-year mean and we believe reflects the company’s poor earnings visibility in the near term.

How we differ: Among the contributors to the Bloomberg consensus, our target price is the lowest, possibly as we believe the market is expecting a sharper turnaround in the company’s earnings.