This article was recently published in the Let's Get Rich Together blog, and is reproduced with permission.

|

|

Notable clients

- Trump Tower, Las Vegas

- Burj Khalifa, Dubai

- Resorts World Sentosa

- Marina Bay Sands

- City Developments

- Capitaland

- Keppel Land - Reflections at Keppel Bay

- GoucoLand Limited

- Far East Organisation

- South Beach Mixed Development

- Westin Hotel, Marina Bay

These big names bodes well for DS' reputation, helping them to gain more clients in the future.

Valuations

Design Studio

PE ratio = 6.8

PB ratio = 1.2

Dividend yield = 11.8% (more on that later)

Kingsmen Creative

PE ratio = 11.5

PB ratio = 2.0

Dividend yield = 4.0%

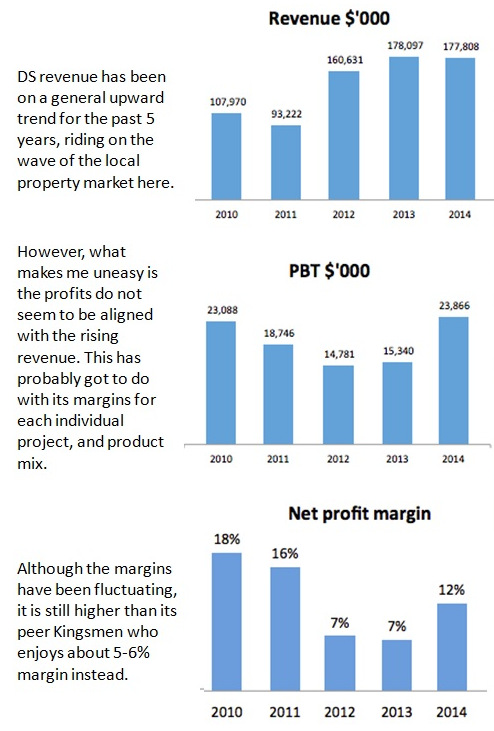

Past results

Comments

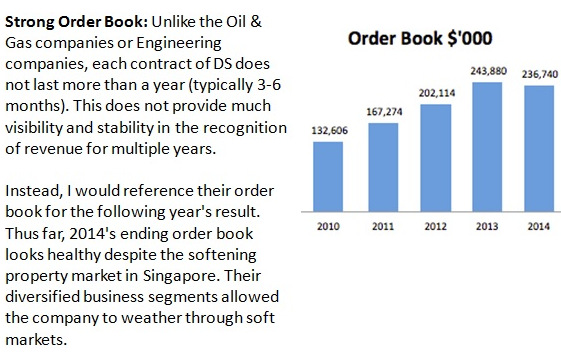

- marginal Qtr profit growth against corresponding 2Q14

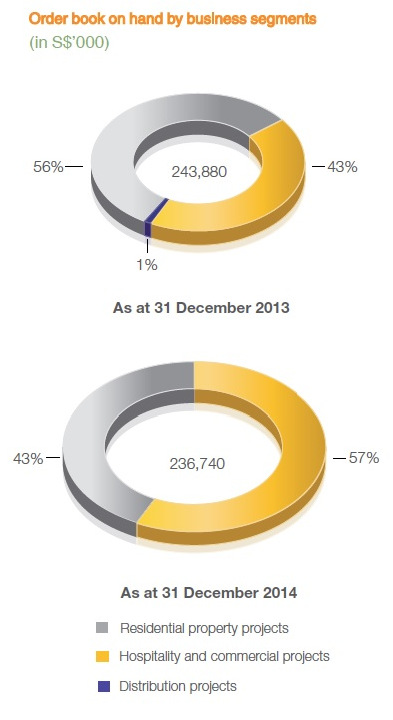

- order books remain solid

- interim dividend per share raised

Performance is impressive considering slower market conditions.

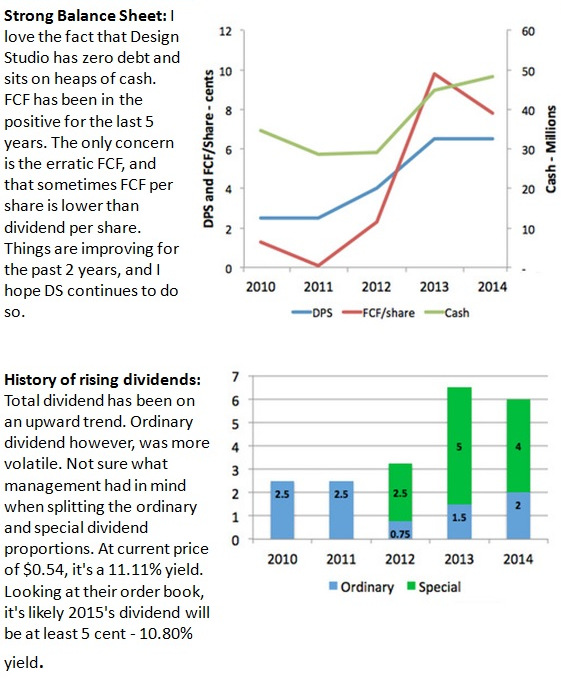

Am vested earlier in view of its established business model, rising order books and strong FCF and financial position. A quality stock and one should hold long term as high yield play..