Excerpts from analyst's report

|

|

» Not just Singapore’s top caterer. Neo Group has built itself a recognisable brand in Singapore’s food catering market since the establishment of Neo Garden in 1992. Today, it is the market leader in food catering with a >10% share. It also has 25 Umisushi outlets and operates its own food supplies arm to provide back-end support.

» Doubling kitchen capacity. The group launched a new central kitchen in Oct 2014, which is expected to double its catering capacity upon ramping up. With added facilities to capture the burgeoning demand for food catering services, we expect the revenue CAGR from this segment to be at 24% over FY15-18F (Mar). We also expect an improvement in its overall EBIT margin to 11.3% by FY18F, up from 9.7% in FY16F and led by increased economies of scale.

» Multiple avenues of growth. Over the years, the company has diversified into F&B retailing and food manufacturing on top of its food catering business. With these budding segments, we expect to see improved profitability from: i) growing Umisushi delivery sales through the leverage of its existing logistics network, and ii) the turnaround of its newly-acquired stake in food manufacturing business, Thong Siek Holdings (TSH), which we project to contribute around 7% of PATMI by FY18.

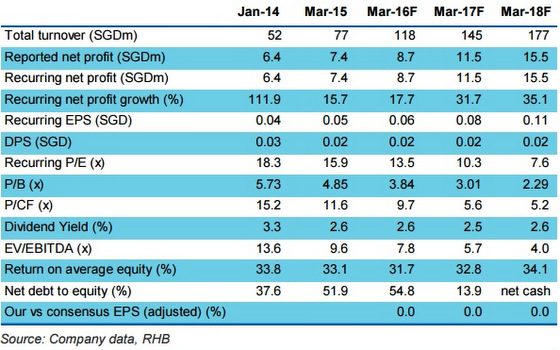

» Get ready to feast; initiate coverage with BUY. Our TP of SGD1.20 is based on a 20x FY16F P/E. Despite its small market cap, we think its valuation is undemanding compared to its peers as we expect a 3-year net profit CAGR of 28% for Neo Group (vs the peer average of 15%). Key risks to our call include the potential need to raise additional capital to fund future acquisitions and the dilution of its core businesses via noncore retail brands.

Full report here.