|

|

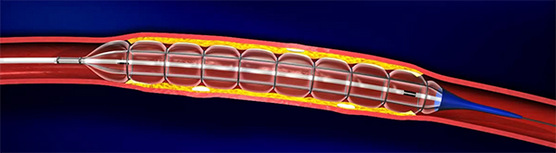

Chocolate PTCA Balloon Catheter: The balloon has rings positioned along its tract that prevent it from expanding into a uniform shape, so the balloon doesn't inflate in the shape of a bone, with the edges being larger than the center of the balloon. Additionally, the valleys that are formed allow large bits of particularly hard calcification to snuggle within them rather than being pushed into the vessel wall where they can cause damage.

Chocolate PTCA Balloon Catheter: The balloon has rings positioned along its tract that prevent it from expanding into a uniform shape, so the balloon doesn't inflate in the shape of a bone, with the edges being larger than the center of the balloon. Additionally, the valleys that are formed allow large bits of particularly hard calcification to snuggle within them rather than being pushed into the vessel wall where they can cause damage.

QT VASCULAR: Q1 2015 revenue grew 16% to US$3.3 million when compared to prior year's Q1.

In volume terms, 8,100 units were sold in Q1 2015, 71% more than prior year's Q1 of 4,700 units.

However, despite revenue growth, the company still reported a loss of US$5.6 million, although it's 39% lower than its prior year Q1 loss of 9.2 million.

Total equity as at end March 2015 was US$24.7 million, US$7 million lower. More than US$106 million accumulated losses was recorded, bring equity down substantially.

Its NAV or equity per share stood at 3.2 cents USD or 4.4 cents SGD.

The company is going to struggle as cash flow will be tight over the coming quarters, unless it quickly turns profitable with positive free cash flow. Capital raising via placement may be necessary unless debt financing is available.

Prior to his retirement, Chan Kit Whye (left) worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He has played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.

Prior to his retirement, Chan Kit Whye (left) worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He has played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.