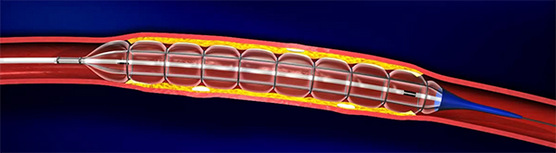

QT Vascular's Chocolate PTCA Balloon Catheter: The balloon has rings positioned along its tract that prevent it from expanding into a uniform shape, so the balloon doesn't inflate in the shape of a bone, with the edges being larger than the center of the balloon. Additionally, the valleys that are formed allow large bits of particularly hard calcification to snuggle within them rather than being pushed into the vessel wall where they can cause damage.

QT Vascular's Chocolate PTCA Balloon Catheter: The balloon has rings positioned along its tract that prevent it from expanding into a uniform shape, so the balloon doesn't inflate in the shape of a bone, with the edges being larger than the center of the balloon. Additionally, the valleys that are formed allow large bits of particularly hard calcification to snuggle within them rather than being pushed into the vessel wall where they can cause damage.

IN ITS LATEST press release, QT Vascular announced in its headline that "QT Vascular achieves net profit of US$15.2 million in 2Q2016".

The net profit is the result of a reversal of US$24.1 million legal liability after the earlier district court judgement was reversed by the United States Court of Appeals for the Federal Court.

That doesn't mean that the company will stay profitable going forward. In fact, without the reversal, its 2Q2016 would report a loss of about US$9 million. Its quarterly operating costs and expenses, including finance costs average about US$10 million.

| Stock price | 7.5 cents |

| 52-week range | 6.6 – 18.3 cents |

| PE (ttm) | -- |

| Market cap | S$71.5 million |

| Shares outstanding | 953.3 million |

| Dividend yield (ttm) |

-- |

| Year-to-date return | --27.9% |

| Source: Bloomberg |

From its balance sheet, there is no way the company could be profitable unless its quarterly revenue come in at about US$22 million with a gross margin of 46%. Its current quarter revenue is US2.4 million, hence, I see the possibility of achieving US$22 million quarterly revenue a far remote possibility.

Its working capital excluding inventory is only US$3.7 million and the company may find it challenging to operate as a going concern. It also has non-matured borrowings of US$8.2 million and payables of US$10.5 million not classified under current liabilities.

After the reversal of legal liability, its equity stood at US$3.25 million, which means that its NAV per share is less than 1 cent SGD. Very soon, the company needs to call for cash via placement or rights to help support its operating costs.

I wonder what the Plaintiff will do next to fight back the decision of the Federal Court. Certainly, the Plaintiff won't just layback and accept its fate.

Prior to his retirement, Chan Kit Whye (left) worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He has played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.

Prior to his retirement, Chan Kit Whye (left) worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He has played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.