|

AN ARTICLE by Channelnewsasia dated 18 Dec 2014 reported that the general healthcare sector has performed well this year and prospects likely remain bright next year. The healthcare index, as measured by the SGX Healthcare Index, registered a year to date return of 9-10% vs the 2% by the STI. Factors such as the aging demographics and rising demand for quality healthcare etc. continue to bode well for the overall healthcare sector. |

Description of QT Vascular

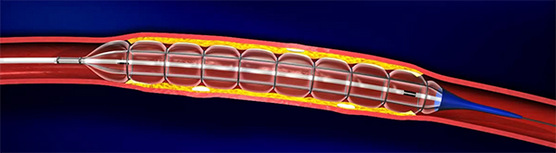

QT Vascular’s value proposition to its customers is that’s its products (i.e. balloon catheters) are less invasive for the treatment of vascular disease without the use of permanent implants (stents). QT Vascular manufactures and sells two types of balloon catheters. They are used to treat either peripheral artery diseases or coronary artery diseases. The catheters are marketed under the Glider and Chocolate brands.

Readers can refer to the company website http://www.qtvascular.com/ for more information.

Investment merits

Industry prospects remain sanguine

According to QT Vascular’s prospectus, the market size for peripheral vascular devices is estimated to grow at a compound annual growth rate of 7.1% from US$4.8b in 2011 to US$7.8b in 2018. The coronary market is arguably larger than the peripheral market. With the aging population and change in healthcare coverage and amount spent etc, these factors are likely to underpin the demand for QT Vascular’s products. Chocolate PTCA Balloon Catheter: The balloon has rings positioned along its tract that prevent it from expanding into a uniform shape, so the balloon doesn't inflate in the shape of a bone, with the edges being larger than the center of the balloon. Additionally, the valleys that are formed allow large bits of particularly hard calcification to snuggle within them rather than being pushed into the vessel wall where they can cause damage.

Chocolate PTCA Balloon Catheter: The balloon has rings positioned along its tract that prevent it from expanding into a uniform shape, so the balloon doesn't inflate in the shape of a bone, with the edges being larger than the center of the balloon. Additionally, the valleys that are formed allow large bits of particularly hard calcification to snuggle within them rather than being pushed into the vessel wall where they can cause damage.

» 4QFY14F results may be strong

4QFY14F results are likely to be buoyed by the ramp up of GliderXtreme PTA products in Asia as new shipment orders of Glider products from China and Japan in 4Q14 are expected to contribute to top-line growth.

Secondly, QT Vascular announced on 15 Oct 2014 that it has signed distribution agreements for the sale of its Chocolate PTA® balloon catheter in Italy, Austria, Turkey, and Australia. This should bode well for its results in 4QFY14F and beyond. Thirdly, QT Vascular’s existing products, such as Chocolate PTA, continue to grow as a result of a 300% year on year increase in U.S. hospital accounts.

» Approvals from regulators provide another catalyst

Firstly, QT Vascular has applied for CE marking approval for its Drug Coated Chocolate Touch in Jul 2014. This approval, if obtained, is expected to be in the next 12 – 18 months. Secondly, QT Vascular may also secure approvals for its Chocolate PTA from China CFDA and Japan Shonin in 2015.

» Possible takeover target

In QT Vascular’s industry, it is a norm for established medical companies to acquire smaller groups for their new and upcoming products. QT Vascular has more products than the other firms which were acquired in the past four years.

It is noteworthy that CVingenuity and Lutonix had not generated any revenue at the time of their takeover. (See page 23 of CIMB report for the graphic comparing these 2 companies with QT Vascular).

As QT Vascular progresses in its product development and sales, it may be able to command a higher valuation due to lower business risk and better earnings visibility.

In addition, I will like to highlight QT Vascular’s CEO Eitan Konstantino’s past work experiences. He was the Founder & President, AngioScore, Inc and CEO & COO, Advanced Stent Technologies which were both acquired. Thus, this may be a sign of his inclination to develop the company and subsequently sell it off. Nevertheless, I hasten to add that this is just my own personal (gut feel) observation.

» Stepping up on investor communication Dr Eithan Konstantino, CEO of QT Vascular.

Dr Eithan Konstantino, CEO of QT Vascular.

NextInsight file photo.According to a CIMB 18 Nov 14 report, management is aware that investors require timely information so that they can track the company’s performance better. Management will be making more timely updates to keep investors apprised of the company’s development.

Notwithstanding the above, there are multiple risks that readers have to be aware of. For a comprehensive list of the risk factors, refer to pg 37 of QT Vascular’s prospectus. Below are some risks for your reference.

Risks

» Loss making company since 2010

QT Vascular has been making losses since 2010 and it is likely that FY2015F may still be loss making. In an interview with The Edge in Sep 2014, management pointed out that the company is focused on research and development (“R&D”) so as to build up its pipeline of products.

Management believes that such spending increases the intrinsic value of the company. In addition, management mentioned that QT Vascular can become profitable quickly if they reduce their R&D expenses and focus on distribution.

» Share moratorium

QT Vascular’s share moratorium ended in late Oct 2014 where the pre-IPO investors, which own 77.4m shares, can sell a maximum of 50% of their shareholding. According to QT Vascular’s prospectus (pg 76), these pre-IPO investors can sell the balance of their shares (if they wish) around 2Q2015.

QT Vascular's stock price has dropped about 21% from $0.355 on 3 Nov to $0.280 on 19 Dec. It is likely that at least some of the pre-IPO investors have exited during this period.

» Not familiar with QT Vascular’s products

I hasten to add that I am not fully familiar with QT Vascular’s products and the scientific data from trials which support the usage of its products.

» Failure to obtain regulatory approval & / or obtain market acceptance

There is no guarantee that QT Vascular’s upcoming products will be able to obtain regulatory approval (e.g. FDA, CE Mark approval etc). Furthermore, after obtaining approval, market acceptance is not a done deal as QT Vascular will need to convince hospitals and distributors to buy its products.

» Limited operating history

QT Vascular has a limited operating history and does not have long-term data regarding the safety and efficacy of its products. Positive results from earlier trials may be negated by regulatory authorities or by later stage clinical trials.

Technical outlook

The prevailing medium term trend for QT Vascular is down as depicted by the red line. However, for the past three weeks, QT Vascular seems to be in the midst of a base formation. A bullish double bottom formation will be formed if it can break the neckline at $0.295 with volume expansion. Measured technical target price is likely to be around $0.325. This formation is invalidated if it breaks $0.265 with volume expansion.

Supports: $0.275 / 0.265

Resistances: $0.295 / 0.315

Conclusion

QT Vascular seems to be a promising company with exciting products. Approvals from regulators, improved 4QFY14F and FY15F results, and improved investor communication etc are likely to be factors for re-rating. However, it is noteworthy that the lack of operating history, its loss making results since 2010, share moratorium and market acceptance are some of the factors to watch out for.

P.S: This is just an introduction to QT Vascular. Readers are encouraged to visit QT Vascular’s website http://www.qtvascular.com/ and refer to analyst reports for more information.