CHIP ENG SENG's Q3 gross profit of $93.3 m came from Belvia (lump sum) plus 9 Residences and Junction 9 and sale of remainder units (no mention of Fulcrum).

This is a pretty big figure, but as no breakdown was given, I can’t tell exactly where it came from. However, my gross profit estimate for Belvia was only $52.8m. That leaves $40.5m for the rest (including construction), which is highly unlikely.

In other words, I probably underestimated profit for Belvia, which is good.

Sited next to the IKEA store in Alexandra Road, Chip Eng Seng's hotel-cum-retail mall project called Alexandra Central is nearing completion. NextInsight file photo.Q3 share of profit from associates amounted to $7.9m, which came from remaining share of profit from Belysa. This brings total share of profit from Belysa to about $16.4m (Q2 $8.5m) which is very close to my own estimate of $16.2m.

Sited next to the IKEA store in Alexandra Road, Chip Eng Seng's hotel-cum-retail mall project called Alexandra Central is nearing completion. NextInsight file photo.Q3 share of profit from associates amounted to $7.9m, which came from remaining share of profit from Belysa. This brings total share of profit from Belysa to about $16.4m (Q2 $8.5m) which is very close to my own estimate of $16.2m.There are some paper losses due to weakening Aussie dollar. This forex risk is to be expected as the co ventures overseas. Not a big concern.

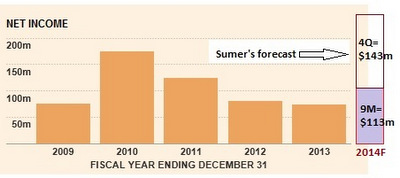

9M earnings is now $113.1m or EPS of 17.7 ct. NAV surged to nearly 91ct.

My forecast for Q4: gross profit from Alexandra Central could come in at $145m, and another $15m perhaps from other projects/construction. Total: $160m.

Net profit (assuming 17% tax rate) would be about $133m or EPS of 20.5ct.

Historical figures for Chip Eng Seng are from FT.comFull year net earnings will therefore hit $246m or 38.2ct, giving the stock a PE of 2.3X. NAV should rise to above $1.10.

Historical figures for Chip Eng Seng are from FT.comFull year net earnings will therefore hit $246m or 38.2ct, giving the stock a PE of 2.3X. NAV should rise to above $1.10.Meanwhile, I have seen an ad for a project manager for its Melaka land. Final approval for this land purchase, however, has not been received.

Recent story: CHIP ENG SENG -- Strong share buyback ahead of FY14 bumper earnings

http://www.nracapital.com/research/sgxresearchreport/1408mne6jh

By Q3 2014, CES' s actual 9mth NAV was already 91 cents but NRA full year NAV forecast was only 92.6 cents.

I expect CES full FY14 EPS to hit around 38 cents, and full-year NAV to hit ~$1.10, but NRA full year EPS forecast was only 27.5 cents, NAV was only 92.6 cents

Even the Phillip Capital Report is deemed to be conservative as it had not taken into account the following into its RNAV computation

http://www.uniphillip.com/development/modulespdf/webinars/PSR%202014-08-25%20(Lantro,%20OCBC,%20Value,%20PanUtd,%20Boustead,%20Chip%20Eng%20Seng).pdf

1. THREE land banks in Australia

2. Profits from TM (even if the project is called, rental yield is ~8%)

3. Profits from Fernvale projects

4. Revaluation Gain from CES centre

5. Recurring income is grossly understated...

6. CES also has its HQ at Ubi and some shop houses at Geylang

7. Profits from Fulcrum

8. Monetization of hotel in the near future..

The RNAV of CES is easily more than ~$2

Would like to check if you have a forecast of FY2015 profit?

The key events for FY2015 are:-

a. Commissioning of the Alex Hotel

[EPS not impact; recurring income will kick in from 2H 2015; NAV will be revalued upwards?]

b. progressive recognition of profits from Junction 9 and Nine Residence

[don't think Junction 9/Nine Residence can TOP by Q4 2015??]

c. Recurring income from construction + San centre + Kilda centre and possibility a new investment property (from the recent issue of $150mil bond).

My estimate is around EPS ~ 15 cents

while NAV gain ~ 43 cents (including revaluation surplus from Alex Hotel).

Thank you.

Mr Market seemed to have priced in the Q4 EPS Gain of 20 cents or so.

FY2015 EPS might drop below 10 cents??

If the Hotel is recorded at cost on CES' book, will it book revelation gain? If no, then the NAV of CES will remain the same even with the commissioning of the hotel? So, there is limited upside gain in NAV?

Is my understanding correct ? tks.

CES is likely to value the hotel in its book at cost. At most, it makes a footnote remark somewhere of its indicative market valuation, but no profit will be booked. Even that I do not think it's likely to do so.

It will just be a "surplus" we all know by doing our own maths.

The valuation of Alexandra hotel can only contribute to income if the company classifies Alexandra hotel as investment property.