Chip Eng Seng Corp CEO Raymond Chia.

Chip Eng Seng Corp CEO Raymond Chia. Photo: InternetCHIP ENG SENG Corporation is one company that has demonstrated its commitment to buying back its shares -- presumably the key reason being their undervaluation.

The buying action has been taking place ahead of bumper earnings to be recorded this year as a result of the expected achievement of TOP of a number of property projects by Chip Eng Seng.

Just look at the number of treasury shares it holds currently -- 30.541 million. These were accumulated from end-2012.

Of late, the company's share buy back has been striking: Since mid-May this year, it has made 5 transactions which were anything but small nibblings of the stock.

In those transactions, it bought back a total of 5.06 million shares in the price range of 74-76 cents a share.

In recent days, the stock has crept up, closing at 78 cents yesterday.

Chip Eng Seng had lots of cash on hand to fund its purchases: It had S$191.8 million cash as at end 1Q this year.

Chip Eng Seng had lots of cash on hand to fund its purchases: It had S$191.8 million cash as at end 1Q this year. However, borrowings were significant too at $743.0 million.

These were taken to finance property development projects and investment properties, the purchase of leasehold land for hotel and commercial development and for working capital.

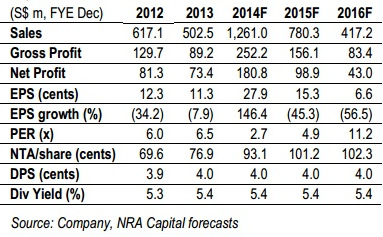

NRA Capital is forecasting strong cashflow this year with cash levels rising to $263 million and total borrowings falling to $567 million. (See NRA report here)

Not only that, the earnings per share this year is forecasted to hit 28 cents a share.

The dividend payout is expected by many investors to be even more generous than the 4 cents a share for FY13 although NRA Capital has not revised its 4-cent forecast.

NRA Capital pegs Chip Eng Seng's fair value at $1.04 based on the sum of the parts methodology for its property development and construction businesses.

Recent stories:

@ Chip Eng Seng's AGM: Update on happenings in Australia and S'pore

Can we conclude that Mr Market has already priced in this event?

Management bought back millions of shares at 0.74 to 0.76 cents. Current Market price is 0.805.

Hence, Market Cap works out to be $516mil.

I did some rough calculation using just one of its projects at Alexandra. it seems that just one major project can already earn enough to cover the current market cap.

450 hotel rooms x per key (range from$0.8mil to $1mil) = 450 x 0.9 = $405 mil (conservative)

Commercial retail space - 90,000 PSF x (selling PSF ranged from 4000 to 8000 PSF) = 90,000 x 5000 (conservative) = $450 mil (REVENUE)

Total cost of land = $189mil.

Total construction cost = say $350 PSF for total GFA of 240,000 PSF = $84mil

Shareholder value from this single project alone ~ $582 mil , which is easily MORE THAN its current market cap, based on very conservative assumptions!!!