THIS IS A one-of-a-kind story -- but unfortunately we don't know the full story.

THIS IS A one-of-a-kind story -- but unfortunately we don't know the full story.

Let's start with an announcement which was submitted to the SGX website on Aug 28 by KSH Holdings, a construction-cum-property developer.

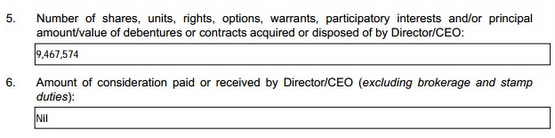

KSH said Lim Kee Seng, who is its executive director, project director and procurement director -- as well as one of its founders -- had disposed of 9,467,574 shares of KSH.

No, the 62-year-old didn't sell the shares since the announcement said he received nothing.

The change of equity interest took place on 22 Aug 2014 and the 9,467,574 shares then had a market value of S$5.2 million (based on the closing stock price of 55 cents which is similar to the current trading level).

In KSH's routine-looking announcement, the reason for the transfer was briefly given as "pursuant to court order" -- which is a most non-routine reason.

So, there was a court case and the judge directed Lim Kee Seng to transfer the shares to certain people. However, the recipient(s) was/were not named in KSH's announcement.

The company is not required to do so anyway, and this looks to be a case involving Lim Kee Seng in his personal capacity.

Despite the setback, he still owns 49,627,171 shares, a 11.98% stake worth about S$27.2 million.

(KSH, by the way, reported record net profit of $44.5 million in FY2014. It has done very well since its IPO in 2007. Prior to that, in FY2006, its net profit was just S$5.7 million. See FY2014 business performance presentation slides here.)

So what was the court case about?

Anyone who Googles "Lim Kee Seng, court" will find two pdf documents which have the court schedule details of a case of Lim Kee Seng vs Chua Siak Neng and another person.

a. On 25 August 2014, the case was heard before Justice Vinodh Coomaraswamy.

b. On 13 March 2014, the parties made oral submissions before Justice Coomaraswamy.

|

|

Recent story: KSH: Professor Emerges As Substantial Shareholder With $11.3 M Stake

1) an old ST obituary listing the name as the son of a dead man.

2) a institute of engineers pdf file listing the name as accredited site supervisor(resident technical officer)