Excerpts from analysts' reportsPhillip Securities Research highlights 800 Super's deep undervaluation

Analyst: Richard Leow, CFTe

|

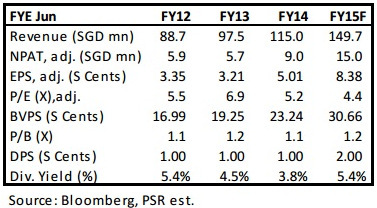

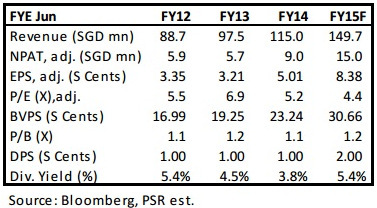

· Double digit CAGR in Revenue (+13.4%) and PATMI (+14.6%) over the last four financial years, outpacing 5% CAGR for total waste generated. · Double digit CAGR in Revenue (+13.4%) and PATMI (+14.6%) over the last four financial years, outpacing 5% CAGR for total waste generated.

· Three new contracts not fully booked into FY14 results; 1HFY15F and full year FY15F forecasted to see strong Revenue and PATMI y-y growth.

· Currently trading cheaply at estimated implied forward P/E of only 4.4x; in contrast to core business contracts at 6 or 7 year tenures.

· Issue "Trading Buy" rating on 800 Super with TP of S$0.670, based on 8.0x FY15F P/E.

|

Investment merits

Two core business segments of waste management and public cleaning each operate in an oligopoly with high barriers to entry.

Distinct advantage of already having two Material Recovery Facilities (MRFs) with a third in the pipe-line, to capitalise on the trend of the shift towards recycling.

Recession-proof business model providing non-cyclical essential services.

Deeply undervalued by the market due to information inefficiency and unglamorous business that is not well understood.

Cash build-up raises the possibility of higher dividends being declared.

Re-rating catalyst

*Forward multiples & yields based on current market price; historical multiples & yields based on historical market price.

*Forward multiples & yields based on current market price; historical multiples & yields based on historical market price. Three new recent contracts that will commence during CY2014 did not fully contribute in FY14 (FYE Jun), but will contribute fully from 2HFY15F onwards. The partial contribution alone for FY14 already resulted in strong y-y growth for 800 Super.

We opine that despite the recent run up in share price for 800 Super following its FY14 results announcement on 26 August 2014, the market still does not fully appreciate what the full contribution by the three new contracts will have on FY15F results, and the new elevated level of earnings in the FYs to follow. 800 Super has effectively expanded its market share for public cleaning services.

|

We recommend a TP of $0.670, based on 8.0x FY15F P/E. We argue that even after applying a punishing 25% margin of safety to our S$0.670 TP to discount for illiquidity concerns and any unforeseen excessive margins-compression, we still arrive at an attractive absolute worst-case of S$0.500 for 800 Super. We recommend a TP of $0.670, based on 8.0x FY15F P/E. We argue that even after applying a punishing 25% margin of safety to our S$0.670 TP to discount for illiquidity concerns and any unforeseen excessive margins-compression, we still arrive at an attractive absolute worst-case of S$0.500 for 800 Super.

Hence, the previous closing price of S$0.370 (with estimated implied forward P/E of 4.4x) still presents a compelling opportunity to exploit the severe mispricing of 800 Super and buy it for a song, while the rest of the market is still blissfully unaware of its true value

-- Richard Leow, Phillip Securities Research.

|

The market is still ignorant of the full impact that the three new contracts will have on FY15F results and beyond due to the absence of active analyst coverage. We advocate that the impact still has not been fully priced-in yet, with about 80% more upside to go!

Investment Actions

We rationalise that 8.0x P/E is a bargain price to pay for a profitable, recession-proof business model, with core business revenue visibility for the next 6 to 7 years and track record of growth. Accordingly, we issue a "Trading Buy" rating on 800 Super, with TP of $0.670, based on 8.0x FY15F P/E.

*Forward multiples & yields based on current market price; historical multiples & yields based on historical market price. Three new recent contracts that will commence during CY2014 did not fully contribute in FY14 (FYE Jun), but will contribute fully from 2HFY15F onwards. The partial contribution alone for FY14 already resulted in strong y-y growth for 800 Super.

*Forward multiples & yields based on current market price; historical multiples & yields based on historical market price. Three new recent contracts that will commence during CY2014 did not fully contribute in FY14 (FYE Jun), but will contribute fully from 2HFY15F onwards. The partial contribution alone for FY14 already resulted in strong y-y growth for 800 Super.

I agree with the question posted by Dawn.