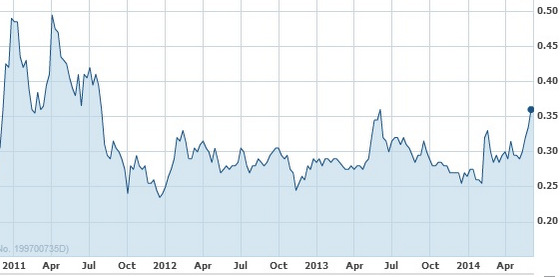

Gallant shares have been trading in a tight range for the past 3 years -- but started to attract investor attention this month. Chart: Yahoo Finance

Gallant shares have been trading in a tight range for the past 3 years -- but started to attract investor attention this month. Chart: Yahoo FinanceTHERE ARE many who are puzzled over, or read it as being highly negative, the sale of shares by Gallant Venture's chairman yesterday.

The sale came about after the stock started to perk up after languishing for a long time. Gallant Ventures recently started to woo and attract analyst coverage.

See our June 10 story: Initiating Coverage: TIONG WOON -- Target 45 C; GALLANT -- 57 C

Last month (May), Daiwa had also come out with a non-rated report on Gallant. Daiwa is said to be hosting Gallant on a roadshow in the US currently.

It appears to be a case of bad timing then that Lim Hock San, the non-executive chairman and independent director of the company, decided to sell a chunk of his shares.

Yesterday (June 12), he sold 1.7 million shares, or 50% of his stake, at 35.5 cents each, leaving him with 1.714 million shares, according to a company filing.

Mr Lim is a prominent figure in Singapore's business landscape, serving also as President and CEO of United Industrial Corporation Limited and Singapore Land.

Gallant stock closed yesterday at 36 cents, and a long way from OSK-DMG's target price of 57 cents.

The stock could be vulnerable to a change in investor sentiment today.

In a similar case recently, UMS Holdings' share price wobbled and slipped after its CEO, Andy Luong, and a substantial shareholder, Applied Materials, sold large stakes.

Analysts issued sell reports. See: Sell calls : UMS -- target 47 cents; HANKORE -- 74 cents

And in the case of Linc Energy, after two insiders sold large chunks, causing a fall in the stock price, the company came out with a statement to explain the personal circumstances that prompted the sales. See: LINC ENERGY: Losses mount but someone's buying the stock!

Recent story: GALLANT VENTURE: Huge land bank in Bintan may be re-rating factor

looks like they bought at the peak !!!

U have to ask yourself , are the local indonesians stupid to sell such a lucrative biz....

Peter Lynch got a term for companies buying biz outside their core competencies. DIWORSIFICATION.