Prior to his retirement, Chan Kit Whye worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He has played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.

Prior to his retirement, Chan Kit Whye worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He has played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School. NEO GROUP: Delivered its full year profits ended 31 January 2014 of $6.4 million, more than double its previous year's profit of $3.4 million.

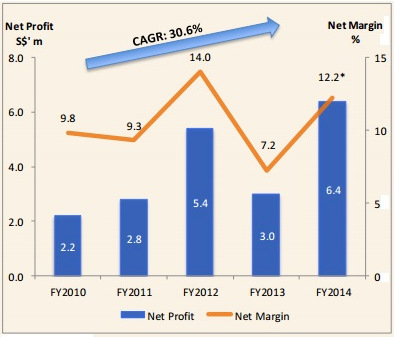

NEO GROUP: Delivered its full year profits ended 31 January 2014 of $6.4 million, more than double its previous year's profit of $3.4 million.

While revenue for the year grew 26% y-on-y to a record $52.4 million, gross margin improved by 31%, resulting in a gross profit of $36.4 million.

Gross margin as a percentage of sales was up 3.8 points to 70.3%, which signals strong control by its management over raw material purchases and costs.

Total expenses were up by 19%, or $4.9 million, to $30.3 million, of which $3.5 million increase came from employee costs and benefits.

Total debt has increased substantially from $3 million in prior year to $16.2 million, largely due to borrowings to acquire 5 units of leasehold properties at Enterprise Road.

This bring its debt to equity very much higher to 78.8% versus 57.2% previously.

Free cash flow has turned negative to $7.2 million versus prior year's positive cash flow of $3.1 million.

This is due to $15 million capex incurred for the year, of which $12 million was for acquisition of properties and $900,00 for investment in Singapore Kitchen Equipment shares.  Founder, Chairman and CEO Neo Kah Kiat with his chefs. Photo: Company

Founder, Chairman and CEO Neo Kah Kiat with his chefs. Photo: Company

|

|