Prior to his retirement, Chan Kit Whye worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He has played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.

Prior to his retirement, Chan Kit Whye worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He has played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School. Tat Hong has a market cap of S$471 m. Out of its 4 business segments, the tower crane rental division is the brightest spot as it rides on the urbanisation trend in China.

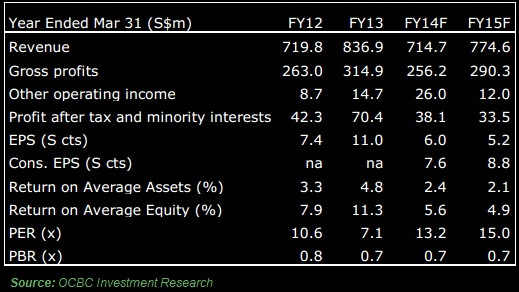

Tat Hong has a market cap of S$471 m. Out of its 4 business segments, the tower crane rental division is the brightest spot as it rides on the urbanisation trend in China. Chart: FT.comTAT HONG: Shares have taken a beating -- they are down from around $1.55 from last year March to $0.77 currently.

The selldown is the result of its 9-month performance, which has been way below expectation.

Year-to-date nine months profit attributable to shareholders is only 40.7% of its last year full year's profits, which has made it very difficult for Tat Hong to do a catch-up.

Dividends may be cut, as its projected earnings per share for its full financial year ending March 2014 will come in at 6-7 cents, as compared to the previous year's 11.57 cents.

Dividend may be cut from 4 cents to 3.5 cents a share.

Although its prospective PE is 13x, its price-to-book ratio is 0.74 times, or its current share price is close to 30% discount to its NAV.

No wonder Executive Director Michael Ng recently bought 203,000 shares from the open market at $0.755 and raised his stake to 0.21%.

|

|