|

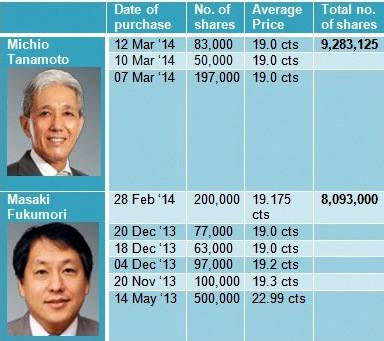

MICHIO TANAMOTO, the chief operating officer of Uni-Asia Holdings, hasn't bought shares of his company in at least the past 5 years. His colleague, Masaki Fukumori, has also been accumulating Uni-Asia's Singapore-listed shares. An executive director of Uni-Asia Holdings and the CEO of subsidiary Uni-Asia Shipping Limited, Mr Fukumori started buying Uni-Asia shares last May. At the current 19-cent level, the stock is selling for only 50% of the book value of Uni-Asia. The dividend yield can be considered decent at 3.29% (based on the proposed final dividend of 0.635 cent a share for FY2013). |

Uni-Asia Holdings suffered losses in the global financial crisis years but has climbed out the slump.For FY2013, revenue dipped 6% to US73.9 million but net profit soared 57% to US$5.6 million.

Uni-Asia Holdings suffered losses in the global financial crisis years but has climbed out the slump.For FY2013, revenue dipped 6% to US73.9 million but net profit soared 57% to US$5.6 million. This marks its fourth year, and best year, of profitability after the global financial crisis.

Uni-Asia has 4 business segments:

Non-consolidated Uni-Asia: This segment reported after-tax loss of US$1.2 million compared to a net profit of US$1.7 million in FY2012.

This segment bears the burden of the headcount and expenses of the Group's staff who work for the shipping and property business segments in Hong Kong and Singapore.

Six ships held by a shipping fund managed by Uni-Asia and 5 held as joint investments come under this segment.

Uni-Asia Shipping: This segment is the best performing, with after-tax profit of US$3.6 million as one more handysize bulker -- the fifth -- was added to Uni-Asia's ship chartering fleet in June 2013, and reaped more charter income accordingly.

Ship charter income is set to rise further when Uni-Asia takes delivery of a new 100%-owned bulker in each of the next three years (2014-2016). A new 51%-owned bulker will also join Uni-Asia's fleet in 2015.

"Ship charter income is the key foundation of our business. We hope to achieve larger operating cashflow in the years ahead," said CFO Lim Kai Ching at a recent briefing on its FY13 results.

In FY13, Uni-Asia generated US$12.1 million of positive operating cashflow, up from US$4.4 million in the previous year.

CFO Lim Kai Ching with analysts after the FY13 results briefing.

CFO Lim Kai Ching with analysts after the FY13 results briefing. Photo by Leong Chan TeikUni-Asia Capital (Japan): The development of small-scale residential properties in Japan and management of property assets there resulted in US$2.7 million after-tax profit -- in part due to one-off gains from the disposal of real-estate assets.

Uni-Asia Hotels: Under this segment, Uni-Asia operates hotels in Japan. It returned to the black with a modest US$503,000 after-tax profit on rising hotel occupancy rates and the cessation of an onerous hotel management contract.

Here are some questions and answers from the FY13 results briefing: Q: Your vessel orders are placed with Japanese yards. Are they the cheapest you can find? COO Michio Tanamoto: We placed orders starting in March last year when prices were almost at the bottom. All 7 newbuildings were acquired at competitive prices. Q: Would they be lower than prices at Chinese yards? Tanamoto: They may be 10-20% higher but Japanese vessels can command better second-hand prices. CFO Lim Kai Ching: Price is one of the considerations. We also take into account the charterers -- we have quality charterers who want our vessels. Q: Are the new orders for fuel-efficient vessels? How much fuel savings do they offer compared to conventional vessels? Itsuro Kurokawa, SVP, Shipping: Yes, they are eco-friendly vessels which have 15-20% lower fuel consumption. Fuel costs are borne by the charterer and has no impact on our financial results. Q: At what BDI (Baltic Dry Index) level would these vessels be profitable for you and you can find charterers? Tanamoto: The charter rates will be at market rates and we can already enjoy good profits as well as cashflow. The break-even level for these small handysize vessels is very low. We have fixed charter rates for 5 of the 7 new ships. Q: How long are the charters for? Tanamoto:. Out of 16 bulk carriers, nine are seaborne. Four have 1-year time charters, the rest are medium term. For the 7 newbuildings, most will be on 5-7 year charters.  Uni Challenge is one of the dry bulk vessels owned by a joint venture which Uni-Asia Holdings is part of. Photo: http://www.shipspotting.com Uni Challenge is one of the dry bulk vessels owned by a joint venture which Uni-Asia Holdings is part of. Photo: http://www.shipspotting.comQ: The shipping industry is still facing an oversupply of vessels -- why are you ordering newbuilds? Tanamoto: Out of our fleet of 23, 16 are small bulk carriers. The reason we are focusing on handysize is, 25% of existing handysize vessels are over 20 years of age and will be scrapped soon. There are 3,000 handysize vessels in the world. Shipyards prefer to take orders for big ships for bigger revenue, so the supply of new handysize is limited. But the demand is stable as handysize vessels can call at any type of port and carry any type of goods. Q: Who are your charterers? Tanamoto: Reputable charterers such as Pacific Basin, the world's largest handy bulk operator, NYK Line and Mitsui OSK Lines. |

The PowerPoint presentation can be downloaded from the SGX website.

Previous story: UNI-ASIA HOLDINGS: Strong 9M profit growth as ship charter income rose