Courage Marine boosted its July-September revenue 46% year-on-year to 5.1 million usd on a higher vessel utilization rate.

Courage Marine boosted its July-September revenue 46% year-on-year to 5.1 million usd on a higher vessel utilization rate.

Photo: Courage MarineCOURAGE MARINE adds Panamax vessel

Courage Marine Group Ltd (HK: 1145; SGX: E91) has acquired MV Hsin Ho, a Panamax-class vessel with a carrying capacity of approximately 72,000 dwt, for a total cash consideration of 8.6 million usd.

40% of the purchase price will be settled by internal resources and 60% will be funded via bank loans, with vessel delivery expected on or before January 16, 2014.

Courage Marine’s fleet currently consists of two Capesize and two Supermax dry bulk carriers, with total tonnage of approximately 417,376 dwt, deployed mainly in Asia.

Courage Marine has been endeavoring to renew its fleet by acquiring newer vessels in place of older ones.

The company previously completed a series of disposals of old vessels and the proceeds of the sales were intended to help acquire vessels when the right opportunity arises.

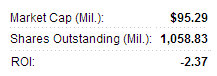

Courage Marine's Hong Kong shares are recently trading at 0.48 hkd with a 52-wk range of 0.25 - 4.10.Courage Marine boosted its July-September revenue 46% year-on-year to 5.1 million usd on a higher vessel utilization rate.

Courage Marine's Hong Kong shares are recently trading at 0.48 hkd with a 52-wk range of 0.25 - 4.10.Courage Marine boosted its July-September revenue 46% year-on-year to 5.1 million usd on a higher vessel utilization rate.

However, due to a 58% surge in the cost of sales and higher bunker and port charges, the third quarter bottom line swung to a net loss of 0.6 million usd compared to a net profit of 0.5 million usd recorded in the third quarter of 2012.

SHENZHEN INVESTMENT inks subway JV

Shenzhen Investment Ltd (HK: 604) has established a joint venture company with Shenzhen Metro Co Ltd (SZMC) to participate in the development of a parcel of land situated at the northeast corner of Metro Line No. 5 (Huangzhong Line) Tanglang transport hub, Nanshan, Shenzhen.

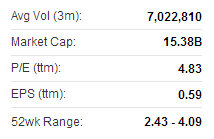

SZ Investment recently 2.86 hkdShenzhen Investment signed a contract with SZMC to acquire a 50% stake in the subway property for 1.21 billion yuan.

SZ Investment recently 2.86 hkdShenzhen Investment signed a contract with SZMC to acquire a 50% stake in the subway property for 1.21 billion yuan.

The project has a land area of 43,584 sq m and GFA of 261,510 sq m.

It is expected to be developed into a complex project with residential and serviced apartments of 132,000 sq m, office space of 50,000 sq m, commercial space of 48,000 sq m and a 30,000 sq m hotel.

Shenzhen Investment is principally engaged in property development, investment and management services, transportation services, infrastructure investment and information technology.

See also:

COURAGE MARINE Shareholding Changes