Goldman Sachs upgrades CHOW SANG SANG to ‘Buy’

Goldman Sachs has raised its recommendation on gold and jewelry retailer Chow Sang Sang (HK: 116) to “Buy” from “Neutral.”

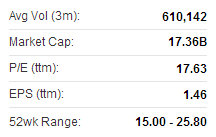

CSS recently 25.65 hkdThe research house also hiked its target price on Chow Sang Sang to 29.0 hkd from 17.5 previously on better prospects for the Hong Kong-based jeweler, which also has a growing presence in Mainland China.

CSS recently 25.65 hkdThe research house also hiked its target price on Chow Sang Sang to 29.0 hkd from 17.5 previously on better prospects for the Hong Kong-based jeweler, which also has a growing presence in Mainland China.

Chow Sang Sang had a standout first half, with its top line surging 55% to hit a record 14.1 billion hkd, leading to a 40% jump in net profit to 615 million hkd.

Credit Suisse recently gave Chow Sang Sang an “Outperform” call, making it among its most favored picks for consumer counters listed in Hong Kong.

KINGWELL raises HK$140 million via placement

Kingwell Group (HK: 1195), which is expanding into the gold mining and processing sector in China and Russia, raised 140 million hkd through the placement of 302 million new shares to no fewer than six placees at 0.48 hkd apiece.

Kingwell recently 0.61 hkd with a 52-week range of 0.41-1.34 and a market cap of 1.0 billion hkd.

Kingwell recently 0.61 hkd with a 52-week range of 0.41-1.34 and a market cap of 1.0 billion hkd.

Source: Yahoo Finance

The placing price represents a 17.2% discount to recent share price levels.

The net proceeds from the placement will be used to reduce interest-bearing loans and as general working capital.

Kingwell recorded a loss of 105 million yuan in the financial year ended June 2013, compared to a loss of 204 million in the year-earlier period.

Kingwell is transitioning from an IT components firm to a gold mining and processing play. Photos: Kingwell

Kingwell is transitioning from an IT components firm to a gold mining and processing play. Photos: Kingwell

In the second half of last year, Kingwell acquired a 51% equity interest in a gold mining firm in Russia.

Kingwell continues its transition from a dedicated electronic components firm to a gold mining and processing play.