Time & date: 10 am, 25 Oct 2013

Time & date: 10 am, 25 Oct 2013Venue: Jurong Country Club

Jack Phang, CFA, is a remisier at Maybank Kim Eng Securities

Jack Phang, CFA, is a remisier at Maybank Kim Eng SecuritiesIT WAS MY first attendance at an AGM of a Singapore-listed company.

One of the reasons why I went was, I would like to meet those directors whose pictures were not printed out in the Annual Report (haha, you may treat it as a joke), and I think EDs & Group CEOs are all handsome and pretty people.

The group CEO (Kuik Sin Pin) is a soft spoken person and I enjoyed chatting with him after the AGM was over.

Here are my notes from the AGM:

1. Sim Lian Group's equity grew from S$200M++ to S$800M++ in just 4 years. I believe it is due to its good strategy of tapping on an uptrend of the property market by introducing higher profit margin projects.

After UB.One is completed, the profit margin may fall to a normalized rate. (Financial Controller mentioned that industrial property projects normally enjoy a higher profit margin compared to residential projects).

UB.One is 100% sold and has obtained Temporary Occupation Permit. Photo: Company

UB.One is 100% sold and has obtained Temporary Occupation Permit. Photo: Company2. Investment Properties have started to appear in the Balance Sheet, with the group's intention to generate more recurring income.

The property bought in Sydney (commercial development which cost AUD65.3 million) would bring in about 6% rental yield. I believe the group was prudent to ensure that the excess cash is taken good care of, although the ROI is definitely lesser than property development projects.

3. Net debt ratio dropped to nearly 0% level in FY2013. It may indicate that the group thinks it is harder to seek a good land bank at reasonable prices.

In fact, they may focus on having more recurring income projects to diversify the concentrated risk of property developments.

4. The reason for joint ventures is to cater for huge CAPEX projects that may exceed group's capacity to do it alone. Anyway, my personal view is that it may increase ROE by pulling Assets & Liabilities out of the group's balance sheet.

Of course, I still think it is a good way to do so as it may capitalize loan to the joint venture in the balance sheet, while still enjoying the shared profit of JV and an increased net profit margin.

I foresee this may be a trend for Sim Lian to park some huge projects in JVs.

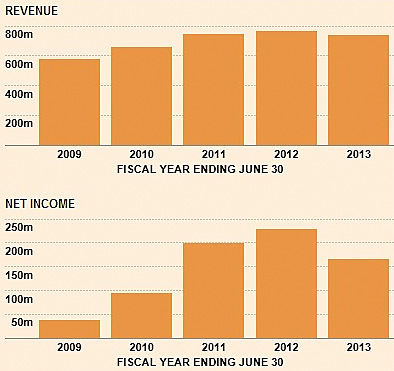

Sim Lian's track record. Charts: FT.com5. Group CEO shared with me that the scrip dividend reinvestment scheme will be offered as and when the group needs cash to support working capital.

Sim Lian's track record. Charts: FT.com5. Group CEO shared with me that the scrip dividend reinvestment scheme will be offered as and when the group needs cash to support working capital.They do not have any intention to privatize the group at this moment although I think they already control at least 70% stake.

Personally, I think the dividend reinvestment scheme is good for those who still think the group has a bright future and are willing to be long term investors.

6. Its 4.6c dividend payout implies about 5.2% dividend yield, which I think is good.

Sim Lian is in the midst of increasing recurring income from properties, so the upcoming net profit may not exceed the record result in FY2012.

If you ask me whether this share is cheap, I think it is not. However, I would opt for the dividend re-investment scheme if there is any.

Ya, this stock is definitely on my watch list and I am still waiting for a chance to increase my exposure to it.

This article was first published in Jack Phang's blog, and is reproduced with permission.

Recent story: SIM LIAN: "Why I Like This Old And Family-Controlled Business"