This article was first published in Calvin Yeo's blog and is reproduced with permission. Calvin Yeo is a Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP) holder. He is also the Managing Director of Calvary Wealth Consultants Pte Ltd where he currently practises wealth consulting and wealth education.

This article was first published in Calvin Yeo's blog and is reproduced with permission. Calvin Yeo is a Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP) holder. He is also the Managing Director of Calvary Wealth Consultants Pte Ltd where he currently practises wealth consulting and wealth education.

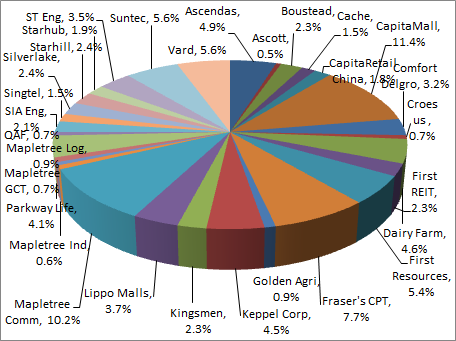

As you can see from my portfolio, I have changed the format slightly by including a decimal point for the % of portfolio numbers.

That is because as the number of stocks in my portfolio grow, some become less than 1%. The past few months have been relatively volatile due to the QE tapering expectations to non-tapering and then the US government shutdown as well as the debt ceiling problems. However, that always poses a good opportunity to invest.

REITS

Suntec REIT’s portfolio comprises office and retail properties in Suntec City (above), among other property assets.I took the chance to increase my stake in the following REITs -- Ascendas REIT, Cache, First, Fraser Centerpoint, CapitaRetail China Trust, Mapletree Commercial Trust, Parkway Life, Starhill and Suntec.

Suntec REIT’s portfolio comprises office and retail properties in Suntec City (above), among other property assets.I took the chance to increase my stake in the following REITs -- Ascendas REIT, Cache, First, Fraser Centerpoint, CapitaRetail China Trust, Mapletree Commercial Trust, Parkway Life, Starhill and Suntec. I like Suntec in particular for its strong growth potential from the completion of the AEI.

In the short term, delayed QE tapering will see some upside for REITs for now and the idea is to stay invested for the dividends as we never know when the QE tapering would end.

Other Dividend Stocks

I also increased my stakes in Boustead, Comfort Delgro, First Resources, Kingsmen, ST Engineering and Silverlake.

All these stocks have strong free cash flow and decent dividend yields. First Resources' strong growth and young profile remain attractive despite relatively weak outlook of CPO.

ST Engineering in particular would continue to benefit from a US recovery and growth in Aerospace industry in Singapore while the rest are more defensive.

SIA Engineering, Dairy Farm and Keppel Corp

I also bought SIA Engineering, Dairy Farm and Keppel Corp. SIA Engineering has very strong recurring income, free cash flows and on top of all that, a huge cash pile.

Like ST Engineering, It will also benefit from increased air traffic in Singapore, the new Changi airport terminal and growing aerospace industry.

Dairy Farm is a hyper/supermarket player 4 main markets, Hong Kong, Singapore, Malaysia, and Indonesia with Hong Kong contributing more than 50% of the revenue. It is the largest supermarket player in Hong Kong with Wellcome and 7-11 stores. Free cash flow is extremely strong and Dairy Farm is building up substantial amount of cash.

Lastly, I am taking position in cyclical large cap Keppel Corp as well due to overall macro environment recovery. Book orders for Keppel Corp are coming in very strongly and it is one of the market leaders in global rig building.

I will also update my global asset allocation in the next post as there is too much focus on local stocks and not enough focus on getting global exposure in asset allocation.