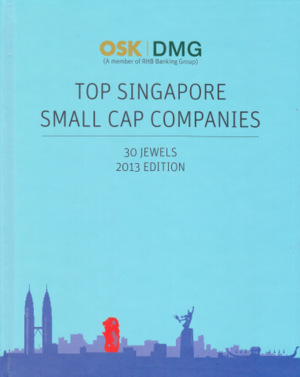

Terence Wong, CFA."The 2012 edition of our Small Cap Jewels made quite a splash. Over 70% of the stocks we picked made money, with the biggest companies making the most. Based on value-weighted averge, the returns were well over 60%." -- Terence Wong, CFA, head of research, DMG & Partners.

Terence Wong, CFA."The 2012 edition of our Small Cap Jewels made quite a splash. Over 70% of the stocks we picked made money, with the biggest companies making the most. Based on value-weighted averge, the returns were well over 60%." -- Terence Wong, CFA, head of research, DMG & Partners. OSK-DMG has recently released its 2013 edition for institutional clients (and it's not for sale).

OSK-DMG has recently released its 2013 edition for institutional clients (and it's not for sale).

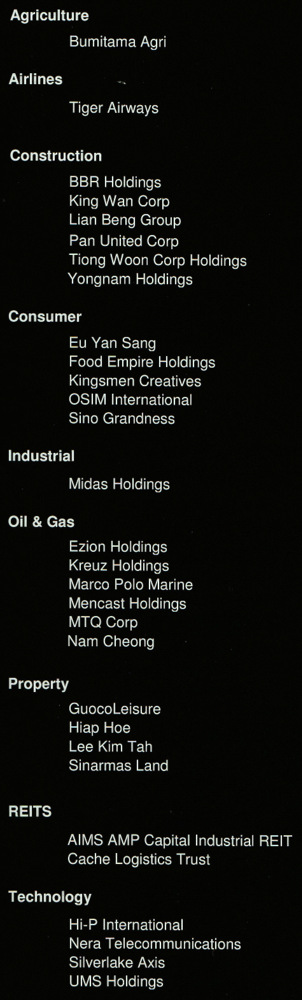

Here are excerpts for 5 of the recommended stocks, the full list of which is in the table on the right:

> King Wan Corp: With its 9.4% expected yield, KWAN compares favourably against REITS' forward 6% yield. Furthermore, KWAN has a strong net cash position and no interest-rate risk. Our SGD0.43 TP is based on a 6.5% dividend yield, in line with Singapore-listed business trusts. -- Lee Yue Jer

> Food Empire Holdings (FEH): FEH's main raw materials are coffee powder, sugar and non-diary creamer. Prices of Robusta coffee beans and sugar have tapered off from their highs. Drop in key raw material prices and a change in its Russian business model assisted the company in expanding gross margin from 45.4% in 1Q12 to 51.2% in 1Q13.  Following the footsteps of Super Group, FEH is building its own non-dairy creamer plant. The plant, located in Johor, will have an annual production capacity of 30k tonnes. Our channel checks reveal that a tonne could fetch ~USD1,500 in the market. Our projections take into account capacity utilisation of 70% ie 24.5k tonnes in 2014 with 30% of it earmarked for internal use. The remaining 70%, or 17k tonnes, can be sold at an average selling price of USD1,500 and generate ~USD26m in sales. -- Melissa Yeap

Following the footsteps of Super Group, FEH is building its own non-dairy creamer plant. The plant, located in Johor, will have an annual production capacity of 30k tonnes. Our channel checks reveal that a tonne could fetch ~USD1,500 in the market. Our projections take into account capacity utilisation of 70% ie 24.5k tonnes in 2014 with 30% of it earmarked for internal use. The remaining 70%, or 17k tonnes, can be sold at an average selling price of USD1,500 and generate ~USD26m in sales. -- Melissa Yeap

> MTQ Corp: MTQ has a low P/E, high growth, attractive dividends and strong cash generation ability. We value the stock at SGD2.20 based on 10x FY14F EPS. To account for its low liquidity, our target P/E is in the middle of 8x-12x range we typically use for small-cap stocks. Except for liquidity concerns, we believe MTQ deserves a higher valuation for its 28% earnings growth. For the long-term investor unconcerned about short-term liquidity, MTQ is a rare gem that checks all the boxes on fundamental strength. -- Lee Yue Jer A Guocoleisure hotel in UK.

A Guocoleisure hotel in UK.

> GuocoLeisure: We value GLL using a sum-of-parts methodology to best capture the disparate nature of its various investments. Our valuation yields a SOTP of S$1.79. We apply a 30% holding company discount to derive a TP of S$1.25. In our view, GLL offers a compelling asset play with imminent catalysts from restructuring within the group and greater transparency on its hotel assets. -- Goh Han Peng

> Hi-P International: Buy on HIP's recovery story. We believe the worst is behind us now. We expect HIP's new organisation structure and more diversified customer base will boost the Group's order outlook. Reiterate Buy, with a SGD0.96 TP, based on a blended 13.5x FY13-14 P/E (-1 SD to its three-year historical forward P/E). -- Edison Chen

Recent stories: