Sam Goi, the Popiah King. NextInsight photoSAM GOI has frequently been in the news for buying shares of listed companies, usually in big spadefuls.

Sam Goi, the Popiah King. NextInsight photoSAM GOI has frequently been in the news for buying shares of listed companies, usually in big spadefuls.

For a change, he has decided to sell out his entire holding in a S-chip which he has held for many years -- China Powerplus.

The company announced on Thursday evening that he had sold 27,880,000 shares that he owned directly.

GSH Corporation, in which he holds a 46.46% interest and holds the post of non-executive chairman, sold all its holding of 14,021,000 China Powerplus shares.

In aggregrate, the 41,901,000 shares were sold on 24 July in an off-market deal to Ms Hao Yanping, a director and General Manager (Administration) of China Powerplus.

She paid S$1,466,535, or 3.5 cents a share, and now owns 66,901,000 shares, representing a 15.75% stake in the company.

China Powerplus' filing with the Singapore Exchange erroneously recorded the 41.901-million share transaction as a disposal of shares by Ms Hao.

She is a newcomer to being a shareholder of the company. It was only in February 2013 that she bought 25 million shares in a married deal from Henry Wee, for 3.5 cents a share. Photos: Annual reportWith the latest transaction, she has now taken over the No.2 shareholder spot occupied previously by Mr Goi.

Photos: Annual reportWith the latest transaction, she has now taken over the No.2 shareholder spot occupied previously by Mr Goi.

The No.1 shareholder is Madam Guo Dianyan (29.87%), an Executive Director and Deputy Managing Director as well as the spouse of the executive chairman, Xue Yongwen.

Neither Madam Guo nor her spouse could have bought the shares from Mr Goi and GSH Corp, unless he or she were prepared to mount a mandatory takeover offer for the rest of the company after crossing the 30%-stake threshold.

Based on the past performance of the company, there is little motivation for the couple to buy more.

China Powerplus has been unable to produce a profit from its business of designing, producing and sale of portable power tools including mist dusters and brush cutters.

In the last four years, the company reported annual net losses ranging from RMB20.2 million to RMB128.1 million.

The 1Q of this year delivered further losses to the tune of RMB4.4 million.

As a result of its losses, China Powerplus has been placed on the SGX Watchlist and has to fufill certain requirements within a certain timeframe or it would be delisted.

The company had another exit story to report this month: Long-time independent director Desmond Ong Tai Tiong resigned with effect from 1 July 2013 and concurrently relinquished his position as Deputy Chairman of the Board, Chairman of the Audit and Nominating Committees and ceased to be a member of the Remuneration Committee of the Company.

The official announcement said: "Mr Ong has been an Independent Director of China Powerplus Limited for almost 9 years and is of the view that it is time for Board renewal."

A mystery lingers: Why has Ms Hao bought shares of her company? Her purchase totalled S$2.34 million, a considerable sum per se for an employee and certainly a considerable sum to risk in a loss-making business which has showed no sign of a turnaround.

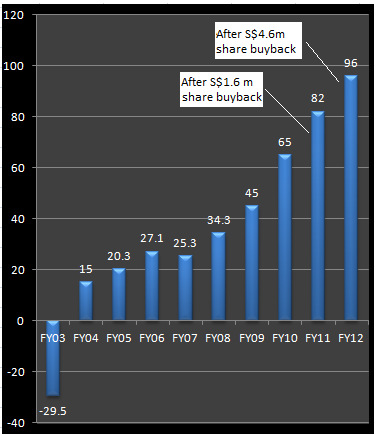

Straco's net cash (above) has soared to S$96 million as at end-2012. It generates strong free cashflow and requires relatively low maintenance capex. The cash level would have exceeded S$100 m last year if not for $4.6m spent on share buyback (but no one's complaining).Out of Straco Corp too

Straco's net cash (above) has soared to S$96 million as at end-2012. It generates strong free cashflow and requires relatively low maintenance capex. The cash level would have exceeded S$100 m last year if not for $4.6m spent on share buyback (but no one's complaining).Out of Straco Corp too

Curiously, Sam Goi has sold out of Straco Corporation too sometime between March 2012 and March 2013.

In the 2011 annual report, he was listed as the No.7 shareholder with 18,651,000 shares, or a 2.17% stake.

In the 2012 annual report, he is no longer in the Top 20 list and is understood to have sold out completely.

Straco, unlike China Powerplus, has proven to be a strongly profitable business (S$19.73 million in 2012) with an unusually high-quality free cashflow.

For more about the company, read:

Comments

"Ms Hao Yanping, a director and General Manager (Administration ) of China Powerplus. now owns .. 15.75% stake... is a newcomer . .. shareholder .. only in February 2013 that she bought 25 million shares in a married deal ..."

"The No.1 shareholder is Madam Guo Dianyan (29.87%), .. spouse of the executive chairman, Xue Yongwen. ..Neither Madam Guo nor her spouse could have bought the shares .. unless he or she were prepared to mount a mandatory takeover offer .. crossing the 30%-stake threshold.

A mystery lingers: Why has Ms Hao bought shares of her company? Her purchase totalled S$2.34 million, a considerable sum per se for an employee and certainly a considerable sum to risk in a loss-making business which has showed no sign of a turnaround."