Both are record amounts. The 10-cents dividend translate to a yield of 6.9% on a recent stock price of $1.45.  Cafe Pho is the best-selling brand in Vietnam for Food Empire.It's a respectable yield but for long-term holders, it is the capital gain that has been outstanding. This time in 2023, the stock stood at around 78 cents. Cafe Pho is the best-selling brand in Vietnam for Food Empire.It's a respectable yield but for long-term holders, it is the capital gain that has been outstanding. This time in 2023, the stock stood at around 78 cents.Food Empire’s net profit after tax increased 25% from US$45.1 million (excluding property gain) in FY2022 to US$56.5 million in FY2023. This was mainly due to higher volumes and/or higher average selling price in all of the Group’s core markets. As Food Empire's financial reporting is in USD, the revenue and profit increases were commendable given that local currencies in Russia and Ukraine depreciated against the US dollar. In South Asia, the revenue increase was driven by higher contribution from the Group’s freeze dry coffee plant in India. |

|||||||||

|

UPCOMING DIVIDENDS |

||

|

Dividends |

FY23 |

FY23 |

|

SGD cents |

1 |

8 |

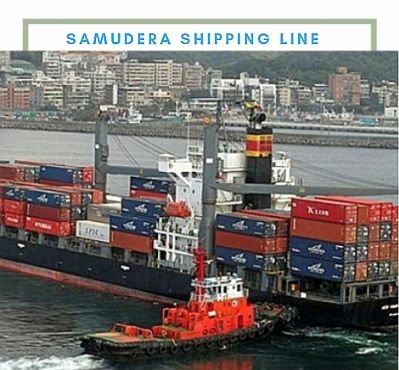

Samudera Shipping Line proposed 8 cents as special dividend and 1 cent as final dividend. It had paid 2 cents as interim dividend.

The upcoming dividends of a total of 9 cents/share translate to a whopping yield of 12.7%. The high yield reflects a market caught by surprise as the stock traded at 72 cents only.

The high yield reflects a market caught by surprise as the stock traded at 72 cents only.

It has traded in the 70s range for most of 2H2023 and 2024 year-to-date.

But Samudera is cash-rich and can afford to give out big dividends.

The upcoming 9-cent/share dividends total S$48.5 million (or US$36 million).

Compare that to the US$359 million cash and cash equivalents Samudera sat on at end-2023.

Its borrowings totalled US$68 million only.

In FY2023, the Group recorded revenue of US$582.9 million, a 41.2% contraction from US$990.6 million in FY2022.

This resulted from significantly lower freight rates in the container shipping segment.

On the other hand, the bulk and tanker segment registered a 70.4% surge in revenue to USD18.3 million, from USD10.7 million a year ago, as a result of higher employment days from a larger fleet.

Net profit after tax was US$101.0 million in FY2023 which was 69% lower compared to the abnormally profitable 2022.

The record yearly profit in 2022 led to a whopping 32-cent dividend paid out.