IN AN article on 26 Dec 2012, we presented a selection of our 2012 articles on 8 stocks that looked promising to readers who posted in our forum.

IN AN article on 26 Dec 2012, we presented a selection of our 2012 articles on 8 stocks that looked promising to readers who posted in our forum. In addition, these past articles have garnered a high volume of hits. We also took into account analysts' recommendations on these stocks.

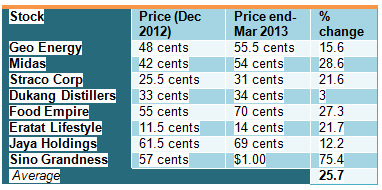

Today, three months on, their stock prices have done OK (see table on the right). Their average price gain was 25.7%, far superior to the 4.4% rise of the Straits Times Index. It's probably got a lot to do with luck too.

Again, considering reader popularity and stock fundamentals and not forgetting a bit of 'tikam tikam', we re-looked things and present here another selection of stocks (4 new, 4 old) and the articles we have done recently about them. We reckon that luck in not small doses are needed once again!

What are your views? Please post them below.

(Prices are as at end of 1Q2013).

Sino Grandness ($1.00):

Sino Grandness ($1.00): 28 Feb 2013: SINO GRANDNESS, ERATAT: Analysts' target $1.38, 27 cents, respectively

28 Jan 2013: OUE, XMH, SINO GRANDNESS: What analysts now say

Dukang Distillers (34 cts):

Dukang Distillers (34 cts):

25 March 2013: DUKANG DISTILLERS, MIDAS: What analysts now say

13 Feb 2013: DUKANG DISTILLERS: 2Q2013 net profit jumps 52.5% to Rmb 144m

GuocoLeisure (88 cts):

GuocoLeisure (88 cts):

27 Mar 2013: GUOCOLEISURE, YING LI: Big discounts to asset values

16 Mar 2013: There's Deep Value in GUOCOLEISURE, says CIMB after company visit

XMH Holdings (28 cts):

XMH Holdings (28 cts):15 March 2013: XMH HOLDINGS: On track for record revenue, profit in FY13

19 Feb 2013: XMH, SING HOLDINGS: Latest happenings

Roxy-Pacific Holdings (63 cts):

Roxy-Pacific Holdings (63 cts):25 Feb 2013: ROXY-PACIFIC, CAPITALAND: What analysts now say

21 Feb 2013: ROXY-PACIFIC: $862 million in property revenue to be recognised over 4 years

King Wan Corp (28 cts)

King Wan Corp (28 cts)27 Feb 2013: ARA ASSET, KING WAN CORP: What analysts now say

7 Feb 2013: KING WAN, ASL MARINE, CHINA MINZHONG: What analysts now say

Food Empire (70 cts):

Food Empire (70 cts): 24 March 2013: FOOD EMPIRE & GUOCOLEISURE: What analysts now say

10 March 2013: FOOD EMPIRE: US$21 m net profit in FY12, upstream projects taking shape

Eratat Lifestyle (14 cts):

Eratat Lifestyle (14 cts):

24 Feb 2013: ERATAT LIFESTYLE: Poised for recovery in absence of one-off expense

22 Jan 2013: ERATAT LIFESTYLE: New distributors likely to be strong catalyst

Henry Ling: i love to be intoxicated and be oblivious to the worldly problems...only this time, Xi Jinping tells all the govt depts not to allow officials to drink, to cut down on floral arrangement, reduce car usage, and other extravagance, to cut down on ceremonies for visiting VIPs and ministers. Dukang caters to businessmen keen to curry favour with top officials and this restraint will eat into its top line and bottom line. The next 10 years should be bad for business in wine and liquor

Jeffire Numero Doce: it's addictive for people in power... more likely businessmen will take the tab. however as of now i find dukang overpriced too.

Leong Chan Teik: Henry has a good point. Maybank recently had a report, which said: >>> The Chinese government implemented new regulations that restricted the consumption of extremely high-end baijiu at luxury government banquets. Following that, there was a significant drop in both retail price and consumption volume reported by some top-end baijiu brands such as Moutai and Wuliangye. For instance the retail prices for some of the Moutai products have fallen by more than 30% from the peak. We haven’t seen such price cut by Dukang but it is possible that the weakness of market leaders could affect it in future.

Tan Peng Hock: Guocoleisure seems tempting.. S chips lost its attractiveness.. until they gives good dividends again.. we shall see..

Henry Ling: Avoid Dukang

Hub Trading: XMH has being buying back their own shares. Good!

Johnny Badarse Sparrow: http://randomsgstock.blogspot.sg/2013/03/guocoleisure-2032013.html. GlucoseLeisdure go in now rugi. wait for more lao sai

Andy Low: King Wan pay very high div...