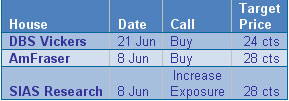

In recent months, Nam Cheong Limited, Malaysia's largest shipyard for offshore support vessels, has attracted the attention of two broking houses. DBS Vickers and AmFraser initiated coverage, citing its strong market position and good earnings outlook as positives.

In recent months, Nam Cheong Limited, Malaysia's largest shipyard for offshore support vessels, has attracted the attention of two broking houses. DBS Vickers and AmFraser initiated coverage, citing its strong market position and good earnings outlook as positives.

Nam Cheong's executive chairman Datuk Tiong Su Kouk

Nam Cheong's executive chairman Datuk Tiong Su Kouk

MALAYSIA’S LARGEST shipyard for offshore supply vessels, Nam Cheong Limited, is benefiting from strong oil prices and the country's Economic Transformation Programme (ETP).

Increased oil exploration and production activities have led to greater demand for Nam Cheong’s AHTS vessels, platform support vessels (PSVs) and other vessels.

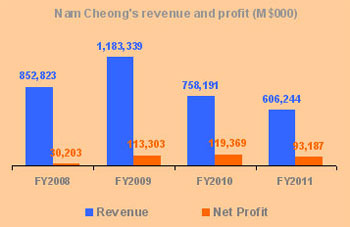

The company was listed on 27 May 2011 through a reverse takeover of Eagle Brand and its earnings were given a shot in the arm after the ETP was rolled out: Its 1Q2012 net profit attributable to shareholders was up a whopping 81% year-on-year at RM33.2 million.

Nam Cheong's core business is in shipbuilding, which contributed 93% to Group revenue in 1Q2012.

It has a second business segment, which is vessel chartering.

It owns and operates a fleet of 7 Standby Support Vessels, 2 Landing Crafts and one AHTS.

Last month, the company announced a letter of intent from Malaysia’s largest offshore oil field services provider, Bumi Armada, to purchase four Multi-Purpose Platform Supply Vessels for US$130 million, with an option to build four additional units.

The latest win brings its order book to RM874 million.

About 50% of Nam Cheong’s orders are from Malaysia, which are directly or indirectly linked to Petronas.

The industry outlook looks bright.

Oil & gas is Malaysia's largest GDP contributor, and its ETP target is to be the no.1 Asian hub for oil field services.

After the ETP initiative was announced, its national oil company, Petronas, revised its planned capital expenditure upwards from RM250 billion to RM300 billion over its financial years 2012 to 2016, or an average of RM60 billion a year.

The revised amount was almost double the RM34.9 billion it invested for its FY2011, which ended in March 2011.

What analysts say

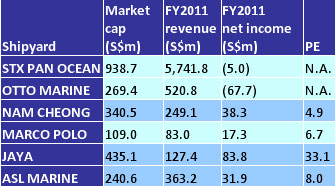

Nam Cheong's recent stock price of 17.6 cents means there is still an upside of 34% to the analyst consensus target of 26.7 cents.

AmFraser analyst Lee Yue Jer:

“Nam Cheong is one of our top picks in the Offshore & Marine sector, with exposure to Malaysia’s booming oil & gas scene. We believe that the RM300b 5-year capital expenditure plan will benefit most players in the industry, and Nam Cheong in particular stands to benefit as the dominant OSV-builder with a 50%-75% market share.”

DBS Vickers analyst Suvro Sarkar:

”With its build-to-stock model, Nam Cheong caters to the demand for urgent vessel requirements from owners, and is thus able to extract better shipbuilding margins than peers.

“Existing cabotage regulations in Malaysia and strong relationships with owners/ charterers put it in a strong position to supply OSVs for future projects in Asian waters. With its build-to-stock model, Nam Cheong caters to the demand for urgent vessel requirements from owners, and is thus able to extract better shipbuilding margins than peers.”